Hedge fund research tools and techniques are indispensable for investors and analysts navigating the complex world of alternative investments. By combining cutting-edge technologies with robust analytical frameworks, hedge funds can uncover hidden patterns and seize lucrative opportunities with unmatched precision. The top hedge fund research tools and techniques empower professionals to stay ahead in the competitive financial landscape by integrating advanced methodologies and insights.

Over the past decade, advancements in statistical models, machine learning algorithms, and big data analytics have revolutionized hedge fund research methodologies. These innovations enable the rapid analysis of massive datasets, market movements, and economic indicators, creating new possibilities for identifying untapped growth areas.

The synergy between quantitative and qualitative approaches further enhances the depth and accuracy of analysis, providing investors with a comprehensive understanding of hedge fund strategies, hedge fund risk analysis, risk management practices, and future performance potential.

Key Takeaways

- Quantitative tools are indispensable for assessing hedge fund performance and risks.

- Emerging technologies like machine learning enhance research precision and depth.

- A blend of quantitative and qualitative insights ensures the most robust analysis.

Key Hedge Fund Research Tools

Hedge fund research tools are designed to manage complex financial data, optimize portfolios, and develop advanced trading strategies. These tools equip analysts and fund managers to stay ahead in the competitive alternative investments landscape, where timely insights and precise execution are key drivers of success.

Data Analysis Platforms

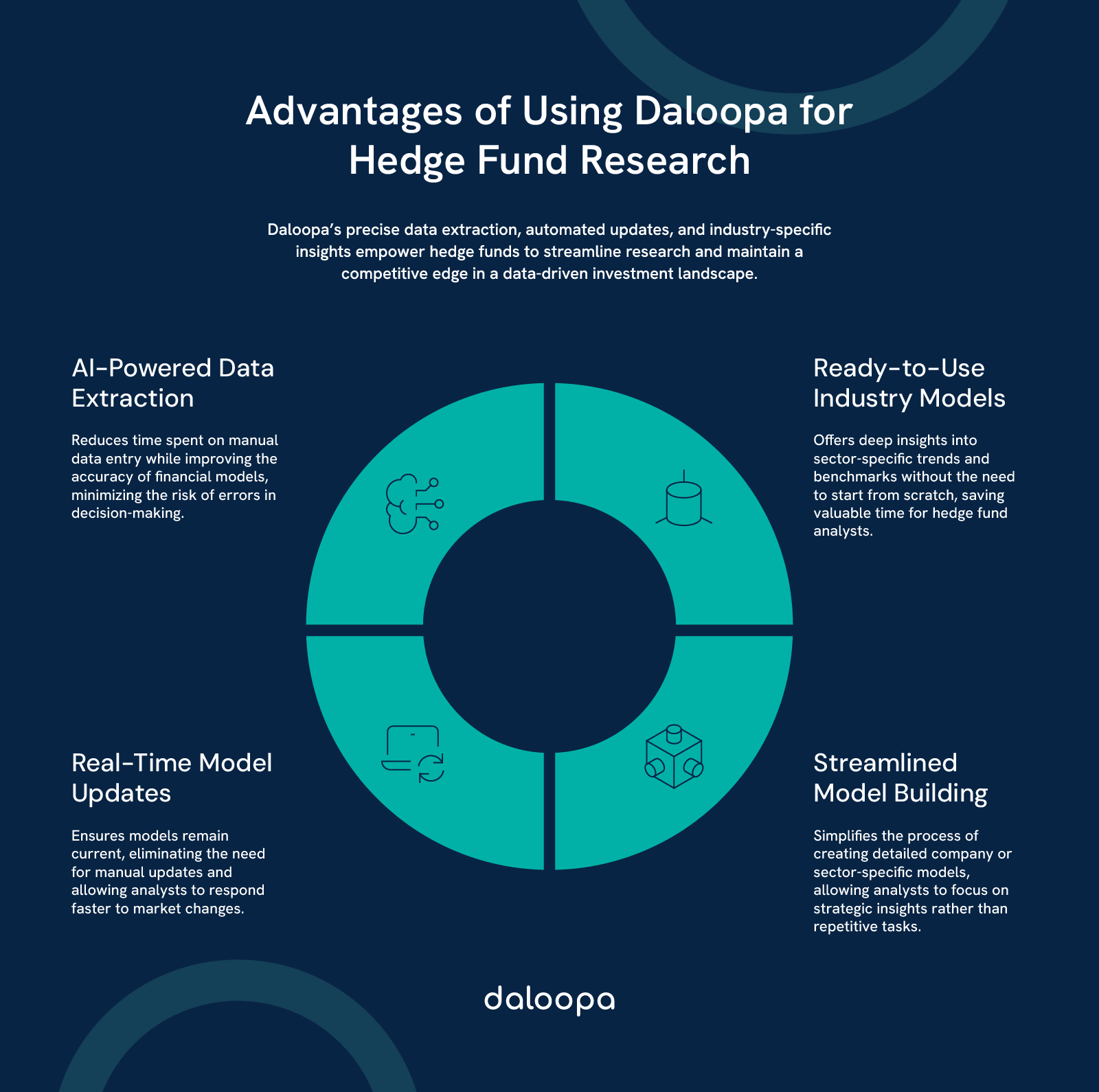

Data analysis platforms like Daloopa are fundamental to hedge fund research, enabling the processing of vast datasets to uncover trends, anomalies, and opportunities. They offer real-time market data, analytics, and news, support informed and swift decision-making, and deliver extensive financial information, robust modeling capabilities, and advanced charting tools.

Hedge funds increasingly leverage alternative data sources, such as satellite imagery and sentiment analysis, to gain unique insights into retail activity or geopolitical trends.

For instance, analyzing credit card transactions (hypothetically) can provide real-time insights into consumer spending patterns. Machine learning algorithms play a pivotal role in sifting through these data sources, identifying hidden patterns, and enabling data-driven decision-making.

Portfolio Management Software

Effective portfolio management relies on tools that streamline asset allocation, performance tracking, and diversification strategies. These platforms offer comprehensive solutions for real-time performance analysis, scenario modeling, and regulatory compliance.

Advanced portfolio management software also provides insights into market exposures and potential vulnerabilities. For example, real-time data aggregation allows fund managers to monitor shifting market conditions and adapt quickly, ensuring portfolios remain optimized even during volatility.

Risk Management Tools

Sophisticated risk management tools offer advanced analytics and scenario modeling to stress-test portfolios and anticipate the impact of extreme market conditions.

Techniques such as Value at Risk (VaR) calculations and Monte Carlo simulations provide frameworks for quantifying potential losses under diverse scenarios. For example, during stress tests, a hedge fund could model the impact of a sudden interest rate spike on its fixed-income portfolio. These tools are essential for comprehensive hedge fund risk analysis, helping fund managers assess exposure to market volatility. Effective hedge fund risk analysis also enables the identification of vulnerabilities, improving decision-making and safeguarding long-term performance.

Trading Strategy Platforms

Trading strategy platforms enable the creation and optimization of models tailored to specific market conditions. High-frequency trading platforms facilitate rapid execution, allowing funds to capitalize on fleeting inefficiencies.

These platforms also support backtesting strategies against historical data, reducing the risk of costly errors. For instance, a fund might use simulations to refine a momentum-based trading strategy, ensuring robust performance across varying market conditions.

Techniques for Effective Hedge Fund Research

Successful hedge fund research integrates quantitative rigor, qualitative insights, and comprehensive performance evaluation. The following techniques ensure a well-rounded approach to fund analysis and decision-making, addressing the diverse demands of stakeholders.

Quantitative Analysis

Quantitative analysis is the cornerstone of hedge fund research, offering a systematic approach to dissecting fund performance and risk profiles. Statistical tools like regression models and factor analysis help identify key drivers of returns and assess sensitivity to market conditions. Risk-adjusted metrics such as the Sharpe and Sortino ratios provide critical benchmarks for evaluating performance.

Advanced techniques, including Monte Carlo simulations, enable funds to explore potential outcomes under varied scenarios. Machine learning models enhance predictive capabilities, uncovering patterns that traditional methods might miss. For instance, an AI-driven model could predict market volatility by analyzing sentiment from social media and news articles.

Qualitative Research

Qualitative research complements numerical analysis by examining the nuances of fund operations. Interviews with fund managers reveal investment philosophies, decision-making frameworks, and risk management practices. These insights are invaluable for assessing less tangible factors, such as team dynamics and cultural alignment.

Due diligence extends to scrutinizing compliance, key personnel, and the adaptability of investment strategies. For instance, a thorough review of a fund’s operational practices might uncover inefficiencies in trade execution, prompting strategic adjustments to enhance performance.

Performance Metrics and Evaluation

Robust performance evaluation is critical for assessing resilience and profitability across market cycles. Metrics like alpha generation, beta exposure, and maximum drawdown offer a comprehensive view of fund performance. Benchmarking against indices such as those provided by Hedge Fund Research (HFR) contextualizes results, highlighting relative strengths and weaknesses.

Attribution analysis dissects returns into skill-based and market-driven components while rolling period evaluations illuminate trends in short-term volatility and long-term consistency. For instance, a rolling analysis might reveal how a fund consistently outperforms during periods of market turbulence.

The top hedge fund research tools and techniques empower fund managers to efficiently analyze vast datasets, optimize portfolios, and manage risk in an ever-evolving market landscape.

Integrating Research Tools Into Hedge Fund Strategies

Strategic integration of research tools optimizes performance and enhances decision-making. Aligning these tools with specific investment objectives and customizing approaches ensures actionable insights and competitive advantages.

Aligning Tools With Investment Goals

Hedge funds succeed by tailoring tools to their strategies. Quantitative-focused funds benefit from high-frequency data analysis platforms, while long-short equity funds rely on advanced screening tools incorporating both technical and sentiment analysis. Custom solutions streamline processes like stock selection, enhancing efficiency and alpha generation.

Customizing Research Approaches

Custom research methods cater to unique hedge fund strategies. For instance, macro funds may prioritize tools analyzing global indicators, while event-driven funds might develop dashboards to track mergers and acquisitions. Tailored approaches uncover hidden value and provide deeper market insights.

Challenges and Considerations in Hedge Fund Research

Hedge fund research involves navigating challenges like data privacy, regulatory compliance, and risk complexity. Addressing these obstacles requires strategic solutions.

Data Privacy and Security

Protecting proprietary strategies is essential. Advanced encryption, secure data protocols, and anonymization techniques ensure confidentiality without compromising analytical depth.

Collaboration with reliable data providers enables accurate analysis while safeguarding sensitive information and balancing transparency and security.

Regulatory Compliance

Navigating the regulatory landscape requires diligence and adaptability. Knowledge of rules like Dodd-Frank and MiFID II, coupled with expert compliance teams, ensures adherence to standards—risk management tools further support regulatory reporting, maintaining alignment with evolving requirements.

Effective hedge fund risk analysis also plays a crucial role in ensuring compliance, as it helps fund managers assess regulatory risks and implement necessary safeguards to align with industry standards.

The top hedge fund research tools and techniques are essential for driving informed decisions and achieving consistent performance in a competitive financial landscape. By combining advanced technologies with robust methodologies, hedge funds can uncover unique opportunities and maintain a strategic edge.

Mastering Hedge Fund Research Tools and Techniques with Daloopa

Professionals must combine cutting-edge tools with rigorous techniques to stay ahead in today’s competitive hedge fund landscape. Platforms like Daloopa provide unparalleled data accuracy and efficiency, streamlining workflows for hedge fund analysts. With Daloopa’s automated data extraction and advanced modeling capabilities, your team can shift focus from manual data entry to high-value analysis and strategic decision-making.

Empower your hedge fund research with Daloopa. Unlock superior insights and drive better outcomes. Visit Daloopa today to learn more.