Be ready for the StubHub IPO

StubHub, the online ticket marketplace, had planned a summer 2024 initial public offering (IPO) targeting a $16.5 billion valuation but postponed it due to unfavorable market conditions. Start your analysis today with Daloopa.

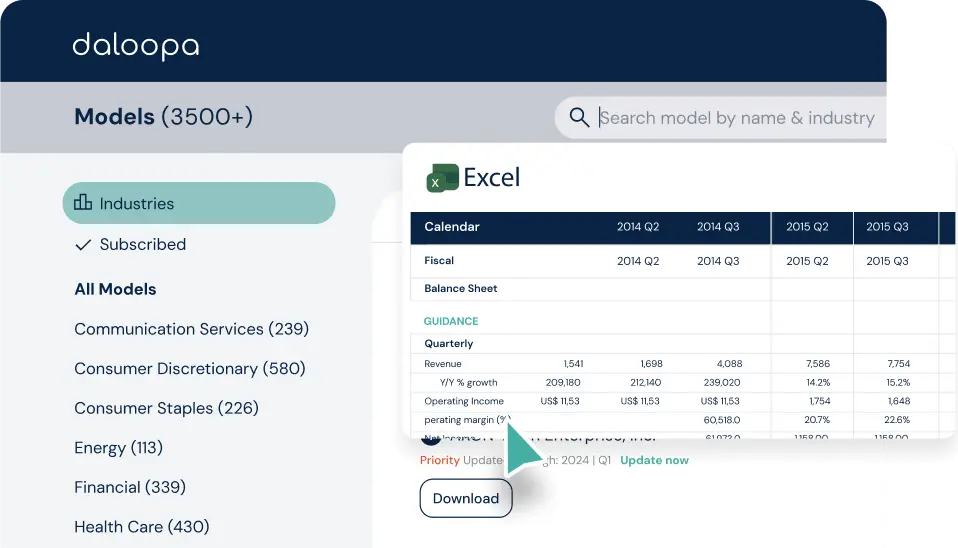

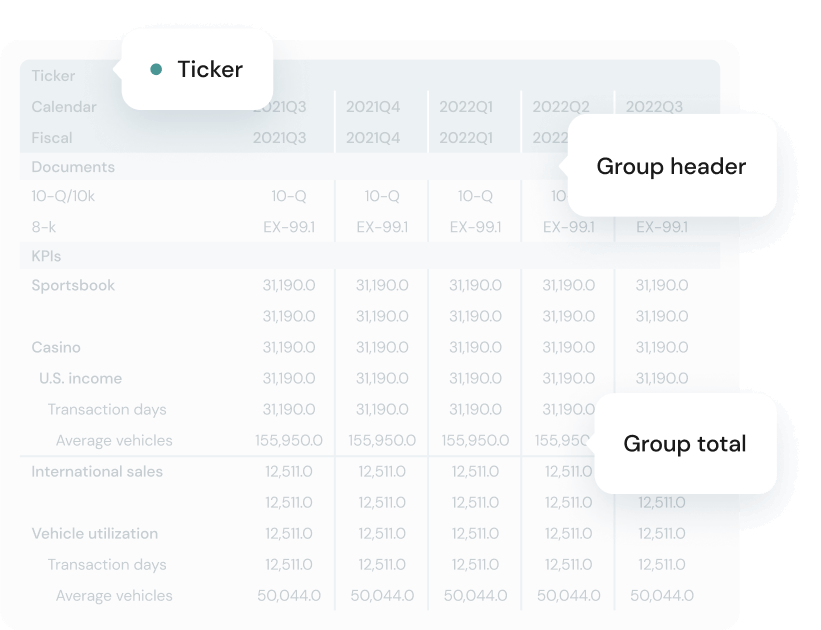

Daloopa provides all the publicly disclosed data -including guidance, debt, KPIs, segmental and geographical breakdowns – in one datasheet and shares updates within minutes of release.

Be one step ahead of the rest.

StubHub IPO Schedule

Filing Date

StubHub initially filed confidentially for a direct listing in January 2022 but did not proceed due to market conditions. As of now, there is no confirmed filing for a traditional IPO, but the company is considering going public in 2025.

Roadshow Dates

Specific dates for StubHub’s IPO roadshow have not been publicly disclosed. Typically, such roadshows occur in the weeks leading up to the IPO to attract potential investors.

Pricing Date

The final IPO price is expected to be determined shortly before the listing date, following the completion of the roadshow and investor consultations.

Listing Date

StubHub initially planned to go public in the summer of 2024, seeking a valuation of approximately $16.5 billion. However, due to “tricky” market conditions, the IPO was postponed until at least September 2024. As of January 2025, the IPO has not yet occurred, and the company is expected to revisit its plans later this year.

Closing Date

The IPO offering period is anticipated to close shortly after the listing date, once all allotted shares have been sold and transactions settled.

Additional Information

Underwriters

StubHub has worked with JPMorgan Chase & Co. and Goldman Sachs Group Inc. as lead underwriters for its previous IPO efforts.

Use of Proceeds

While specific allocations have not been publicly detailed, it is expected that the funds raised from the IPO will be utilized to:

- Expand into new markets

- Enhance technological infrastructure

- Invest in marketing and customer acquisition

- Pursue strategic acquisitions

Major Shareholders

Key stakeholders in StubHub include:

- Viagogo: The parent company that acquired StubHub from eBay in 2020 for $4.05 billion.

- Other investors: Notably, Bessemer Venture Partners, Madrone Capital Partners, Index Ventures, and various individual investors.

Valuation

StubHub was seeking a valuation of approximately $16.5 billion for its IPO in 2024. This valuation target remains relevant for a potential 2025 IPO.

Oversubscription

Information regarding potential oversubscription of StubHub’s IPO will become available closer to the offering date, based on investor demand during the roadshow.

StubHub Valuation & Financials

Valuation Metrics

Pre-IPO Valuation

StubHub was seeking a valuation of approximately $16.5 billion for its IPO in 2024. This valuation target is still relevant for a potential 2025 IPO.

Price-to-Earnings (P/E) Ratio

Specific P/E ratio information is not available, as StubHub remains a privately held company.

Enterprise Value

The enterprise value will be determined based on the IPO valuation and capital structure at the time of listing.

Financial Statements

Revenue

Detailed revenue figures are not publicly disclosed. StubHub’s revenue is primarily derived from service fees and promotional partnerships.

Net Income

Specific net income figures are not available. The company has been investing heavily in growth and technological enhancements.

Cash Flow and EBITDA

StubHub’s EBITDA was reported to be around $350 million in 2024. Detailed information on cash flow is not publicly available.

StubHub IPO Prospectus

Link to SEC Filings

As StubHub has not yet filed a public S-1 for its IPO, the SEC filings are not yet available.

Summary of Prospectus Key Points

Key details will be provided upon the public release of an official prospectus, expected closer to the IPO date.

StubHub Market Cap

StubHub’s market capitalization will be determined once the IPO is completed and the shares commence trading.

StubHub Stock Price

As a privately held company, StubHub does not have a publicly traded stock price. Post-IPO stock performance will be monitored upon listing.

Interested in other companies?

Create a free account to get access to five more free models for free.

About Daloopa

We believe that AI technology can improve clarity and efficiency for investors and financial markets.

Daloopa was formed in 2019, inspired by our founders’ personal experience at Point72, a NYC- based/short equiy hedge. Accurate data is central to all investment decisions and can influence speed and confidence for decision-makers. We believe that institutional finance has an opportunity to embrace tech-driven accuracy and speed.