Be ready for the Klarna IPO

Klarna has submitted the F-1 Form with the intent of going public in the U.S. Start your analysis today with Daloopa.

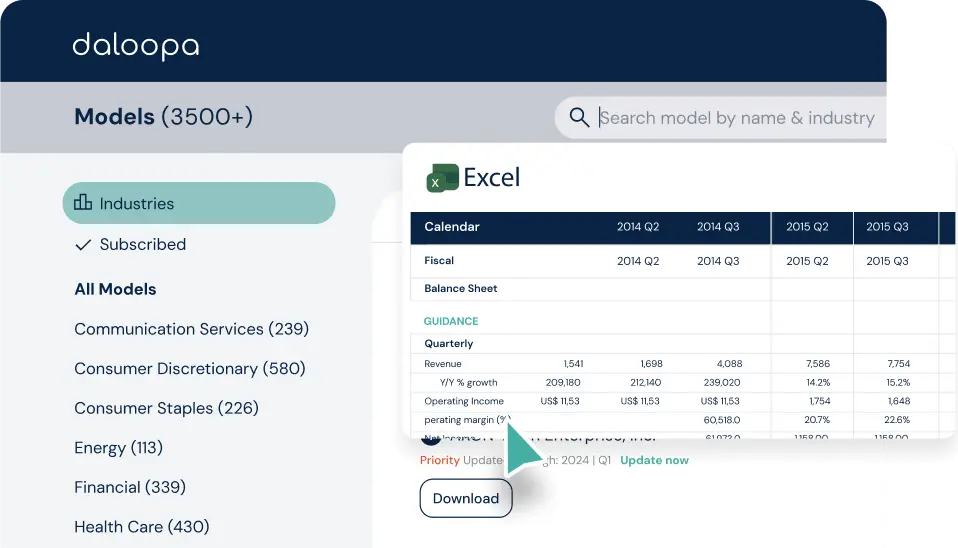

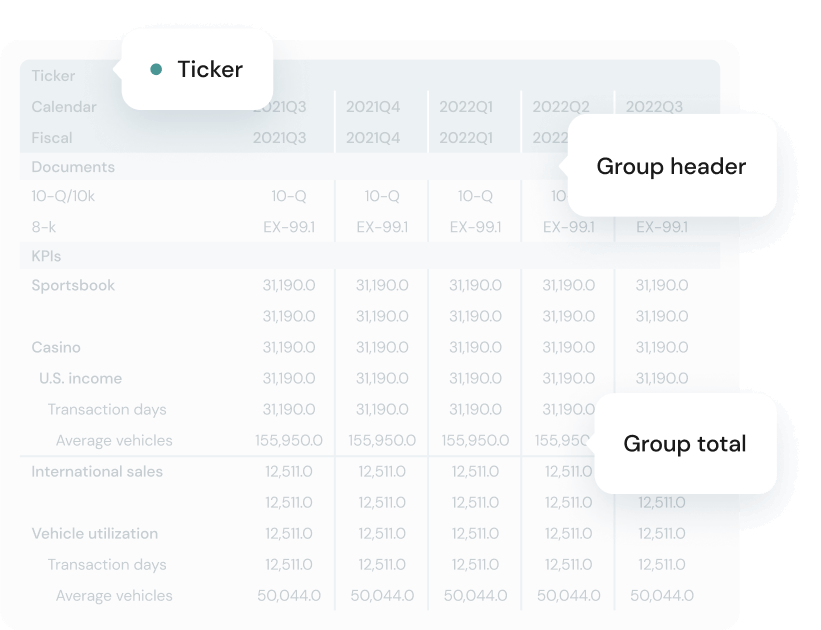

Daloopa provides all the publicly disclosed data -including guidance, debt, KPIs, segmental and geographical breakdowns – in one datasheet and shares updates within minutes of release.

Be one step ahead of the rest.

Klarna IPO Schedule

Filing Date

Klarna confidentially submitted a draft registration statement on Form F-1 to the U.S. Securities and Exchange Commission (SEC) on November 12, 2024, signaling its intent to go public in the United States.

Roadshow Dates

Specific dates for Klarna’s IPO roadshow have not been publicly disclosed. Typically, such roadshows occur in the weeks leading up to the IPO to attract potential investors.

Pricing Date

As of now, Klarna has not announced the final IPO price or the exact date when this pricing will be determined.

Listing Date

The exact date when Klarna’s shares will commence trading on a public exchange has not been officially confirmed. However, reports suggest that the IPO is anticipated to take place in the first half of 2025.

Closing Date

The closing date of the IPO offering period will be established once the listing date is confirmed and the offering is completed.

Additional Information

Underwriters

While Klarna has not officially announced its IPO underwriters, reports indicate that the company is close to selecting major financial institutions such as Goldman Sachs, JPMorgan Chase, and Morgan Stanley to lead the offering.

Use of Proceeds

Klarna has not publicly detailed how it plans to utilize the funds raised from the IPO. Typically, companies allocate IPO proceeds for purposes such as expanding operations, investing in technology, paying down debt, or pursuing strategic acquisitions.

Major Shareholders

Key stakeholders in Klarna include Sequoia Capital, a prominent venture capital firm; CEO Sebastian Siemiatkowski, co-founder and chief executive officer of Klarna; SoftBank, a significant investor in the fintech space; and Commonwealth Bank of Australia (CBA), which holds a notable stake and is reportedly considering selling down its stake ahead of the IPO.

Valuation

Klarna’s valuation has experienced significant fluctuations: it achieved a peak valuation of $45.6 billion in 2021, declined to $6.7 billion in 2022, and is expected to be valued between $15 billion and $20 billion for its IPO.

Oversubscription

Information regarding potential oversubscription of Klarna’s IPO is not currently available. Such details typically emerge closer to the offering date.

Klarna Valuation & Financials

Valuation Metrics

Pre-IPO Valuation

As of late 2024, Klarna’s valuation is anticipated to be between $15 billion and $20 billion, reflecting a recovery from its 2022 low of $6.7 billion.

Price-to-Earnings (P/E) Ratio

As Klarna has recently returned to profitability, specific P/E ratio calculations will become available once detailed earnings per share data is released post-IPO.

Enterprise Value

The enterprise value will be determined post-IPO, taking into account the market capitalization, debt, and cash reserves at that time.

Financial Statements

Revenue

In 2023, Klarna reported revenues of approximately SEK 20 billion, marking a 23% increase from the previous year.

Net Income

Klarna achieved a net profit of SEK 216 million ($20 million) in the third quarter of 2024, primarily driven by its expansion in the U.S. market.

Cash Flow and EBITDA

Specific figures for cash flow and EBITDA have not been publicly disclosed. However, Klarna has emphasized improvements in operational efficiency and profitability, partly due to the integration of artificial intelligence and cost-cutting measures.

Klarna IPO Prospectus

Link to SEC Filings

As the draft registration statement was submitted confidentially, it is not yet publicly accessible. Once the SEC completes its review and the filing becomes public, it will be available on the SEC’s EDGAR system.

Summary of Prospectus Key Points

Key details from the prospectus will be available upon its public release. These typically include information such as the IPO date, ticker symbol, share price, and financial disclosures.

Klarna Market Cap

Klarna’s market capitalization will be determined once the IPO is completed and the shares commence trading. This will provide a clearer picture of how its market cap compares to its pre-IPO valuation.

Klarna Stock Price

Information on Klarna’s stock performance, including stock price, percentage change from the IPO, and 52-week range, will become available once the company is publicly traded.

Interested in other companies?

Create a free account to get access to five more free models for free.

About Daloopa

We believe that AI technology can improve clarity and efficiency for investors and financial markets.

Daloopa was formed in 2019, inspired by our founders’ personal experience at Point72, a NYC- based/short equiy hedge. Accurate data is central to all investment decisions and can influence speed and confidence for decision-makers. We believe that institutional finance has an opportunity to embrace tech-driven accuracy and speed.