LCID Investor Relations

Get all historical data on Lucid Group

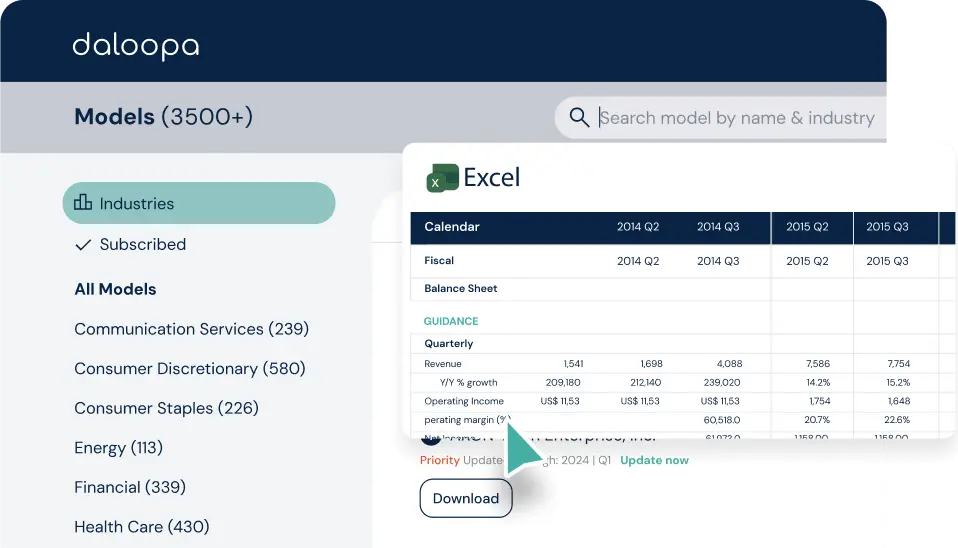

Stop wasting time on manual entry and start making faster, smarter decisions with accurate, up-to-date LCID numbers you can trust.

- Deep dive into the latest Lucid Group earnings data, including segmental KPIs, GAAP to Non-GAAP, Guidance, Adjustments and more.

- Access the original source file in one click with hyperlink technology on every single data point.

- Use the data how you want it with our flexible delivery format.

Download now and get the data you need to stay ahead.

Get all the historical Lucid Group fundamental data in one place with the Daloopa Data Sheet.

Lucid Group SEC Filings & Financial Statements Last 5 Years

2024 Earnings

2024 - Q4

2024 - Q3

2024 - Q2

2024 - Q1

2023 Financial Disclosures

2023 - Q4

2023 - Q3

2023 - Q2

2023 - Q1

2022 Financial Disclosures

2022 - Q4

2022 - Q3

2022 - Q2

2022 - Q1

2021 Financial Disclosures

2021 - Q4

2021 - Q3

Lucid Group Investor Relations Presentation

Lucid Group specializes in designing and manufacturing high-performance electric vehicles, particularly focusing on luxury models. Their flagship vehicle, the Lucid Air, has received acclaim for its advanced technology, long range, and high performance. The company aims to compete with established brands like Tesla by offering premium features and superior driving experiences. Additionally, Lucid is expanding its production capabilities with new facilities, including a plant in Saudi Arabia.

Lucid Group Head of Investor Relations

The current Head of Investor Relations at Lucid Group is Rafael (Raffi) A. Amini. He plays a crucial role in managing communications between the company and its investors, ensuring transparency regarding financial performance and strategic initiatives.

Lucid Group Investor Relations Email & Contact Us

For investor inquiries, Lucid Group provides contact information through their official investor relations page. While specific email addresses are not typically disclosed in public forums for privacy reasons, interested parties can usually reach out via their contact form on their website or directly through email at investor@lucidmotors.com.

LCID Last Stock Split

As of now, Lucid Group (LCID) has not undergone any stock splits since its inception as a public company. This means that all shares have maintained their original value without any adjustments through splitting or consolidating shares.

LCID Investor Relations Website

For detailed financial reports, press releases, and other investor-related information, visit Lucid Group’s Investor Relations website: https://ir.lucidmotors.com/

Covering more companies?

Create a free account to access up to 5 free data sheets.

Daloopa is your gateway to the latest data during earnings, including KPIs, guidance, GAAP to Non-GAAP and more, all formatted for immediate use.

Are you ready to stop wasting time on manual entry and start making faster, smarter decisions with accurate, up-to-date numbers you can trust? Create your free account today and get the data you need to stay ahead.

Create Free Account

About Daloopa

We believe that AI technology can improve clarity and efficiency for investors and financial markets.

Daloopa was formed in 2019, inspired by our founders’ personal experience at Point72, a NYC- based/short equiy hedge. Accurate data is central to all investment decisions and can influence speed and confidence for decision-makers. We believe that institutional finance has an opportunity to embrace tech-driven accuracy and speed.