First Quarter Out of the Box

Coreweave (CRWV) reported its first quarter as a public company following its March initial public offering (IPO), with strong topline growth of 420% year-over-year. However, guidance pointed to increased capital expenditures (capex) and lower operating income, which may raise concerns after the stock’s recent 60% rally.

RPO vs. Revenue Backlog

In the case of CRWV, Goldman Sachs, Morgan Stanley and JP Morgan served as the joint lead bookrunners. Note that only one of these firms is able to open the stock; that firm likely receives the most in underwriting fees. Interestingly for Coreweave the stock priced at $40 and closed at exactly that level, indicative that there was some support by the firm that opened the stock to stabilize it. The bank’s trader can stabilize the stock by using the “greenshoe” which is a standard overallotment that allows underwriters to purchase up to an additional 15% of the offering size. So as the stock undergoes selling, the underwriters buy shares back to offset the selling pressure.

Issuing companies seek broad research coverage and distribution by Wall Street banks so they placate these banks by giving them joint bookrunner and co-manager roles in order to receive some of the underwriting fees. In Coreweave’s case, there was a total of 18 banks as part of the syndicate, with 15 banks serving as joint bookrunners or co-managers. In the case of Coreweave, given their need to frequently access the capital markets to finance their heavy capital expenditures, they likely wanted a full suite of banks at the ready.

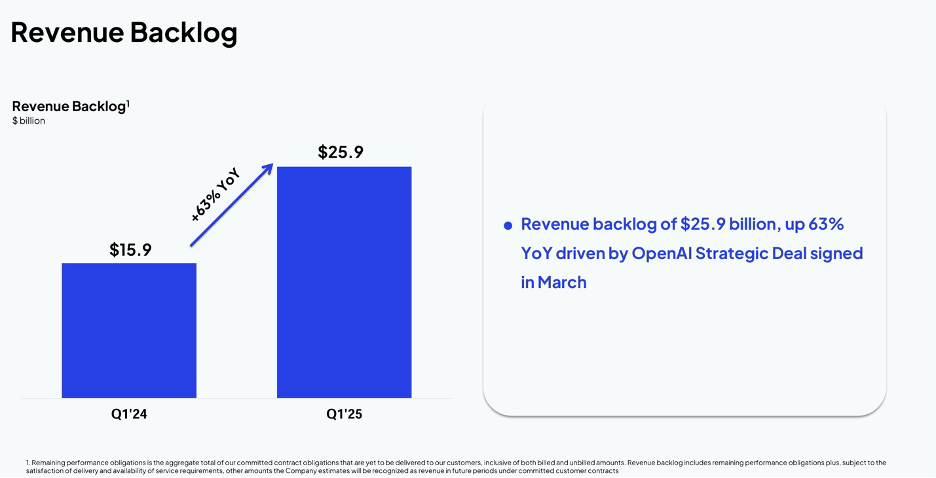

If you look at the GAAP-compliant RPO number of $14.6 billion, it has decreased by 8% year over year. Since the OpenAI contract was not included in the RPO, it suggests that the contract does not meet the GAAP definition of a non-cancellable contract, as it carries certain risks. Out of the $14.7 billion RPO, 58% will be recognized in the next two years, with the remainder coming in 2 years or later.

2025 Capex Raised Aggressively

Coreweave raised its capex guidance by roughly $3 billion to $20-23 billion, well ahead of where the Street had come out following the IPO. On a cash flow basis, the company generated only $61 million in operating cash flow in the quarter, well below the Street estimates of $800-900 million as interest expense came in higher and there were fewer upfront payments from new customers. When deducting capex including capitalized software of $1.4 billion, free cash flow was negative $1.35 billion for the quarter.

Net Takeaway

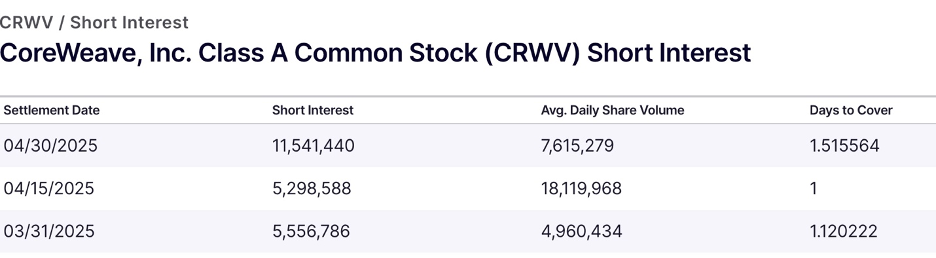

Retail appears to be driving the stock, as institutions remain solidly underweight or short the stock, as evidenced by a more than two-fold increase in short interest in late April.

With an underwhelming IPO that required downsizing the round, I anticipate another equity offering in the near future with the stock at these elevated levels. Sporting a market cap of $40 billion and an enterprise value of $50 billion for a capital-intensive, cash burning business with massive customer concentration (the number one customer accounts for 72% of Q1 revenue) seems quite risky.