Effective financial modeling color coding provides clarity and efficiency in financial modeling, especially in complex models used by investment banking analysts. By differentiating between inputs, calculations, and references, standardized color coding helps users navigate spreadsheets quickly and accurately, reducing errors.

Using distinct colors for constants, formulas, and assumptions streamlines model review and improves transparency. When applied correctly, this practice aligns with industry standards and enhances communication and decision-making within financial analyses.

Key Takeaways

- Consistent color coding organizes data for better readability.

- Standardized practices improve model transparency.

- Color coding enhances utility in complex financial statements.

Standard Color Coding Practices for Financial Models

Maintaining clear and consistent color coding allows analysts to quickly distinguish between inputs, formulas, and potential errors, streamlining model navigation and reducing the risk of mistakes.

Black Font: Text and Labels

Black ensures text and labels stand out from numerical data and formulas, enhancing model readability, especially in complex spreadsheets where swift identification of sections and data categories is critical. Black can also be for calculations within the same sheet. Using black for text maintains a clean, professional look, making collaboration and review more efficient.

Blue Font: Hard-Coded Inputs

Blue is reserved for hard-coded numbers or manual inputs, such as projections or historical data. These are the figures most likely to change during updates, and marking them in blue helps analysts easily locate and revise inputs as needed, minimizing the chance of errors during data entry and fostering transparency during model updates and audits.

Green Font: Formulas and Calculations

Green is for calculations that reference other sheets and clearly separates dynamic data from static inputs, ensuring that analysts can quickly identify which cells contain calculations that automatically update as inputs change. It also aids in troubleshooting, as formulas can be verified without being confused with hard-coded data, helping to maintain model integrity.

Red Font: Errors or Critical Issues

Red highlights errors or critical issues that require immediate attention. When inconsistencies or potential problems arise in the model, red font ensures these are easily spotted and addressed, serving as an alert system and allowing analysts to quickly focus on areas that need correction to preserve the model’s accuracy and functionality.

Advanced Excel Mechanics in Color Coding

In financial modeling, color coding within Excel enhances clarity, efficiency, and accuracy in complex financial models. Color coding helps differentiate between inputs, outputs, assumptions, and calculations, and allows analysts to easily identify key trends, perform variance analysis, and quickly spot outliers in large datasets. Financial models can be made even more dynamic and user-friendly by integrating more advanced techniques like conditional formatting, named ranges, and VBA for automatic color coding.

Selecting and Formatting Cells

Using Excel’s “Format Cells” menu, you can manually assign colors to different cell categories. For instance, using light blue for input cells makes it easy to identify where to update or adjust figures, especially in the case of dynamic inputs such as revenue forecasts or variable costs. This clear separation of inputs, outputs, and assumptions reduces the risk of manual errors and enhances the model’s usability, particularly when shared across teams or reviewed externally.

Conditional Formatting for Dynamic Insights

Conditional formatting is a powerful tool for automating color coding in financial models based on specific rules. By automatically changing the appearance of cells when they meet predefined conditions, this feature highlights critical data points like key performance indicators (KPIs), identifies variances, and flags outliers. For example, conditional formatting can highlight KPIs such as revenue growth or profit margins in green if they exceed targets or in red if they fall below expectations.

Conditional formatting allows you to easily analyze large datasets, as it eliminates the need for manual checks. Analysts can set up automatic alerts for key thresholds, ensuring real-time updates as data changes.

Named Ranges for Structured Data Management

Named ranges for structured data management are another advanced technique that enhances the clarity and functionality of financial models. Instead of using cell references like “B2,” named ranges allow you to assign descriptive names to specific ranges of cells, such as “Revenue_Growth” or “Operating_Expenses.”

By assigning names to important cell ranges, analysts can create more intuitive formulas, reducing the likelihood of errors. For instance, instead of referring to “=B2/C10” to calculate a profit margin, a formula like “=Revenue/Operating_Expenses” is much easier to understand and audit. Additionally, combining named ranges with color coding allows users to see at a glance which inputs or assumptions drive key financial metrics.

Named ranges also simplify updating models. When new data needs to be added, updating a named range will automatically adjust all formulas and formatting rules that depend on that range, reducing the manual work involved in maintaining complex models and ensuring consistency across multiple sheets.

VBA for Automated Color Coding

Integrating Visual Basic for Applications (VBA) allows for automated color coding, making large-scale models easier to manage. VBA can be used to write scripts that automatically apply color codes based on user-defined rules.

For example, a VBA script can automatically color all input cells in blue, all output cells in green, and any cells with formula errors in red. This automation eliminates the need to manually apply color codes, saving time and reducing the risk of inconsistent formatting across the model.

Moreover, VBA can be combined with conditional formatting and data validation to enhance the model’s functionality further. For instance, VBA could be used to automatically highlight cells exceeding a certain threshold while triggering a data validation rule to prevent users from entering invalid data.

Integrating Color Coding with Data Validation

Data validation is another technique that pairs well with color coding in financial models. You can prevent erroneous data entries by setting validation rules—such as allowing only numbers between a specific range or enforcing a particular date format. Data validation provides a dual layer of protection and clarity when combined with color coding.

For example, you can use data validation to restrict input cells to a range of acceptable values, such as a discount rate between 0% and 20%. By color-coding these cells in light blue and using conditional formatting to flag any entries outside the acceptable range in red, the model becomes more resilient to user error. This visual cue immediately alerts users to potential mistakes, while the underlying validation rule prevents invalid data from being entered in the first place.

Types of Color Coding in Financial Models

In investment banking, effective color coding within financial models enhances readability and facilitates efficient navigation through complex spreadsheets. By assigning unique colors to different data types, analysts can streamline their workflow and reduce the likelihood of errors.

Input Cells

Input cells are critical for capturing variable data that can significantly impact the model’s outputs. Light blue is commonly used to differentiate these cells. This consistent color scheme allows analysts to swiftly identify areas that require updates, minimizing the risk of unintentional modifications to other model components.

Clearly marked input cells guide users to relevant data and improve focus during updates or reviews. Additional formatting, such as borders or bold text, can further enhance the visibility of these cells, making them stand out in intricate models.

Output Cells

Output cells display the results of calculations derived from input data and are typically highlighted in light green. This color coding ensures that users can quickly locate critical outcomes and summaries without confusion.

Analysts can efficiently verify results and assess the model’s performance against expectations by maintaining a consistent color for output cells, allowing for a clear distinction between inputs and outputs and facilitating quicker reviews without the need to dissect the underlying calculations.

Calculation Cells

Calculation cells contain the formulas that transform inputs into outputs, serving as the backbone of the financial model. These cells are often designated with a color such as green and yellow to emphasize their importance and signal that they should be edited with caution.

Protecting calculation cells from accidental alterations is a best practice, as their integrity is essential for accurate outputs. The distinct color highlights their significance and aids in auditing and troubleshooting by making it clear where to focus attention if discrepancies arise.

Industry Standards for Color Coding in Financial Models

Color coding in financial models improves clarity and ensures accuracy, particularly in complex forecasting and financial analysis models. These standards are designed to differentiate between various types of data, such as hard-coded values and formula-based calculations, facilitating easier collaboration and reducing the potential for errors.

Defining Industry Standards

Several organizations and financial institutions set informal standards for color coding in financial models, although practices can vary between firms. The Financial Modeling Institute (FMI) and various CFA programs emphasize the importance of adhering to such color conventions to streamline model auditing, reviewing, and updating processes. While color coding with black, blue, green, and red form the industry standard, it is up to each individual financial institution to confirm how they designate each color and what those colors connect to.

Hard-Code vs. Formula Cells

A key aspect of financial modeling is distinguishing between cells that contain manually entered data (hard-coded values) and those that are formula-driven. In most models, hard codes are colored blue, indicating that these numbers are direct inputs, such as historical sales figures or fixed capital expenditures. Formula-based cells, typically shaded black, alert users that the values result from calculations rather than manual entries. For example, formulas calculating revenue growth, margins, or cash flow projections would be color-coded accordingly to ensure clarity.

Consistency and Best Practices

While color conventions may differ slightly between firms or sectors, maintaining consistency within a model is critical. A uniform color scheme not only aids in navigating multi-sheet models but also reduces the risk of misinterpretation when the model is shared among team members or external parties.

In investment banking, where models are often reviewed by various stakeholders, including senior management and clients, consistent color coding is essential for ensuring accuracy and speeding up the review process.

Application of Color Coding in Financial Statements

Color coding plays a pivotal role in financial statement analysis by enhancing readability, improving the ability to spot trends, and highlighting critical data points. Analysts and stakeholders can rapidly identify variances, assess financial performance, and make more informed decisions by applying specific colors to distinct sections of financial statements—balance sheets, income statements, and cash flow statements.

Balance Sheets

In balance sheets, color coding is essential for distinguishing between assets, liabilities, and equity, improving the clarity and structure of the data presented. For example, green might be used to highlight current assets, such as cash and accounts receivable, which are expected to be converted to cash within a year. This allows stakeholders to assess the liquidity of the company quickly. Contrasting this with a red color for liabilities enables users to easily compare assets and liabilities, giving a clearer snapshot of the company’s solvency and financial health.

For further clarity, long-term assets like property, plant, and equipment might be shaded in a different color, such as light green, while long-term liabilities could be in dark red. This differentiation provides an instant visual cue, helping analysts distinguish between short-term and long-term financial obligations, which is essential when evaluating liquidity and long-term sustainability.

Color coding also aids in spotting trends over time. For instance, using deeper shades of green for assets that have grown significantly or lighter shades for those that have diminished can provide a quick visual representation of changes. Similarly, a decrease in long-term debt could be represented with a lighter shade of red, signaling improvements in the company’s debt management. This use of color intensity helps stakeholders quickly assess performance across multiple reporting periods without needing to dig through every figure.

Income Statements

In income statements, color coding helps to differentiate between various revenue streams and expense categories, providing a clearer overview of profitability. For instance, blue could represent all revenue lines, immediately drawing attention to the company’s income-generating activities.

Analysts can track income sources more effectively by separating them visually. For example, different shades of blue might represent different revenue streams, such as product sales, services, and other income, making it easier to identify which areas are driving growth.

Orange, for example, might be used to represent expense categories, ensuring a clear contrast with revenue. This distinction between income and expenses is crucial for understanding a company’s cost structure and assessing its overall profitability.

Furthermore, shading within the same color can help differentiate between expected and actual expenses, with deeper shades highlighting areas where expenses have exceeded forecasts. This color-coding approach provides a quick visual cue, alerting analysts to areas of concern, such as cost overruns or shrinking margins.

Cash Flow Statements

In cash flow statements, color coding plays a crucial role in distinguishing between different types of cash flow activities—operating, investing, and financing—enabling better financial analysis and quicker identification of cash trends. For example, purple could be used to highlight operating cash flows, which represent cash generated from the company’s core business activities.

Yellow might be employed for investing activities, which include asset purchases and sales, such as capital expenditures (CapEx) or investments in securities. By separating these activities from operating cash flows, stakeholders can quickly assess how much the company is reinvesting in its long-term growth or liquidating assets to generate cash.

Teal could signify financing activities, such as the issuance of debt or equity and the repayment of loans or dividend payments. This tri-color system makes it easier to assess how the company is funding its operations—whether through internal cash generation, investment activities, or external financing.

The use of color in cash flow statements also facilitates trend analysis. For example, increasing shades of purple could indicate growing cash generation from operations, while a darker yellow might highlight significant capital expenditures. By providing a quick visual representation of where cash is being generated and where it’s being spent, this system helps analysts spot potential cash flow issues, such as over-reliance on financing or declining operational cash flow. This clarity is essential for maintaining effective cash management strategies and ensuring the company remains financially stable.

Enhancing Model Usability with Color Coding

Investment banking analysts can significantly improve navigation and comprehension within complex models by implementing a clear and standardized color scheme. By consistently applying these conventions, analysts create a more user-friendly experience that allows team members to quickly identify and differentiate between various components of the model. This practice improves usability and enhances data entry accuracy by clearly marking input cells, which helps minimize errors.

Research shows that utilizing visual elements, such as color coding, can improve analytical processing and decision-making, enabling users to spot risks or essential data points at a glance quickly.

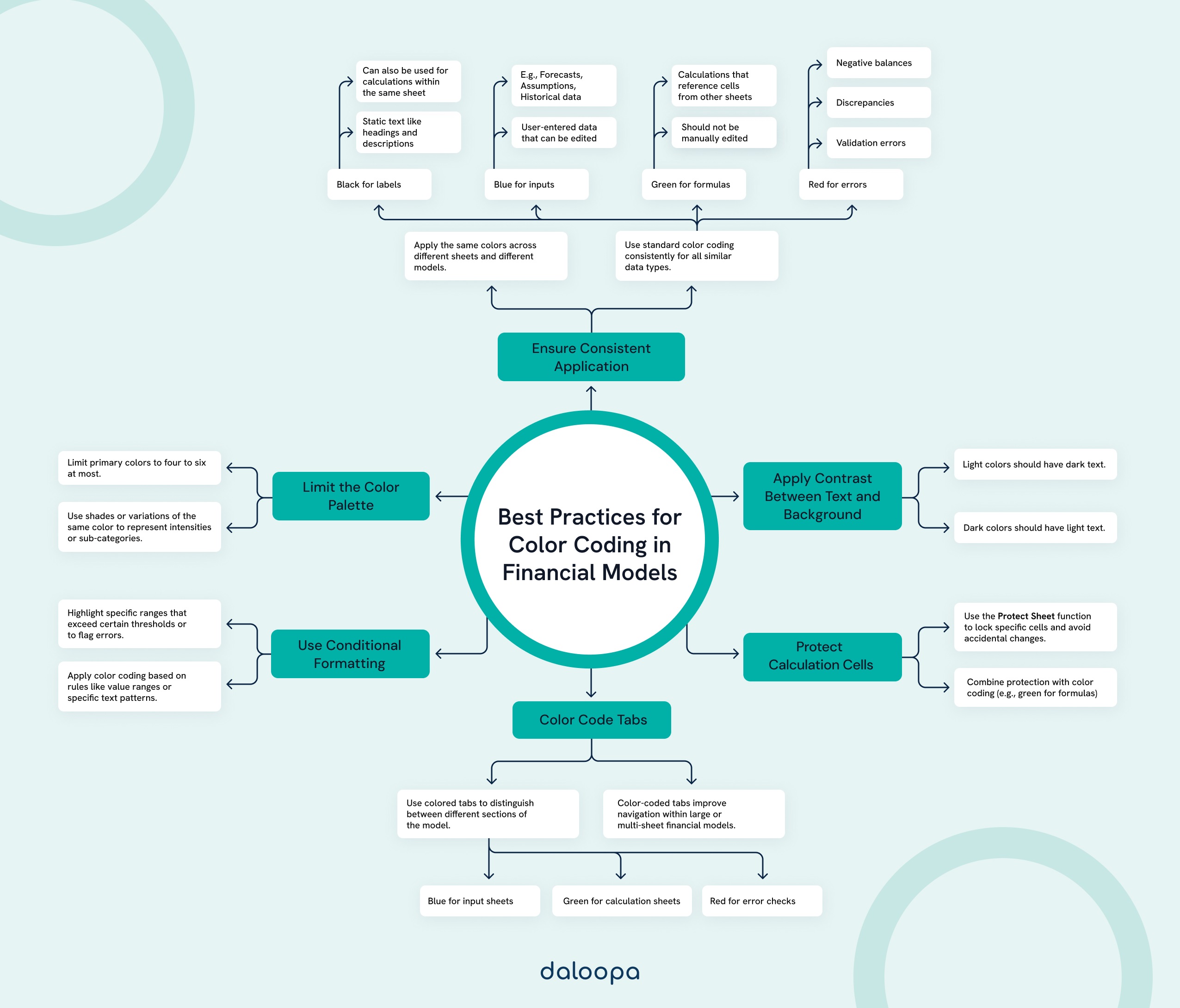

Best Practices:

- Limit the color palette to enhance clarity.

- Maintain consistency across models to avoid confusion.

- Use contrast effectively to highlight critical information.

Master Financial Modeling Color Coding with Daloopa

When it comes to financial modeling color coding, Daloopa offers tools that elevate your financial models.

Explore types of color coding to streamline inputs, outputs, and calculations, or stay aligned with industry standards for color coding in financial models to enhance accuracy and collaboration. Our platform helps you apply these techniques across all your statements, ensuring smooth navigation and usability with every financial model.Curious about how Daloopa can enhance your modeling process? Let’s talk about how we can help simplify and optimize your workflows without the hassle.