Earnings Per Share (EPS) and the Price-to-Earnings (P/E) ratio reveal both a company’s profit power and how the market prices that power. By comparing a stock’s price against each share’s earnings, you cut through the noise and spot value or risk before others do.

Key Takeaways

- EPS and P/E offer direct insight into financial strength and valuation.

- Rising EPS generally signals improving profitability; P/E helps compare across companies.

- Pairing both creates a clearer picture for evaluating stocks using financial ratios and metrics.

Understanding EPS and P/E Ratio

When assessing a company’s financial position and share price, EPS and P/E act as a double-check. One measures profit, the other tells us what investors are paying for it. This dynamic creates a useful context for judging whether a stock deserves more attention or caution. They’re two of the most critical financial ratios and metrics used by professional analysts.

Defining Earnings Per Share (EPS)

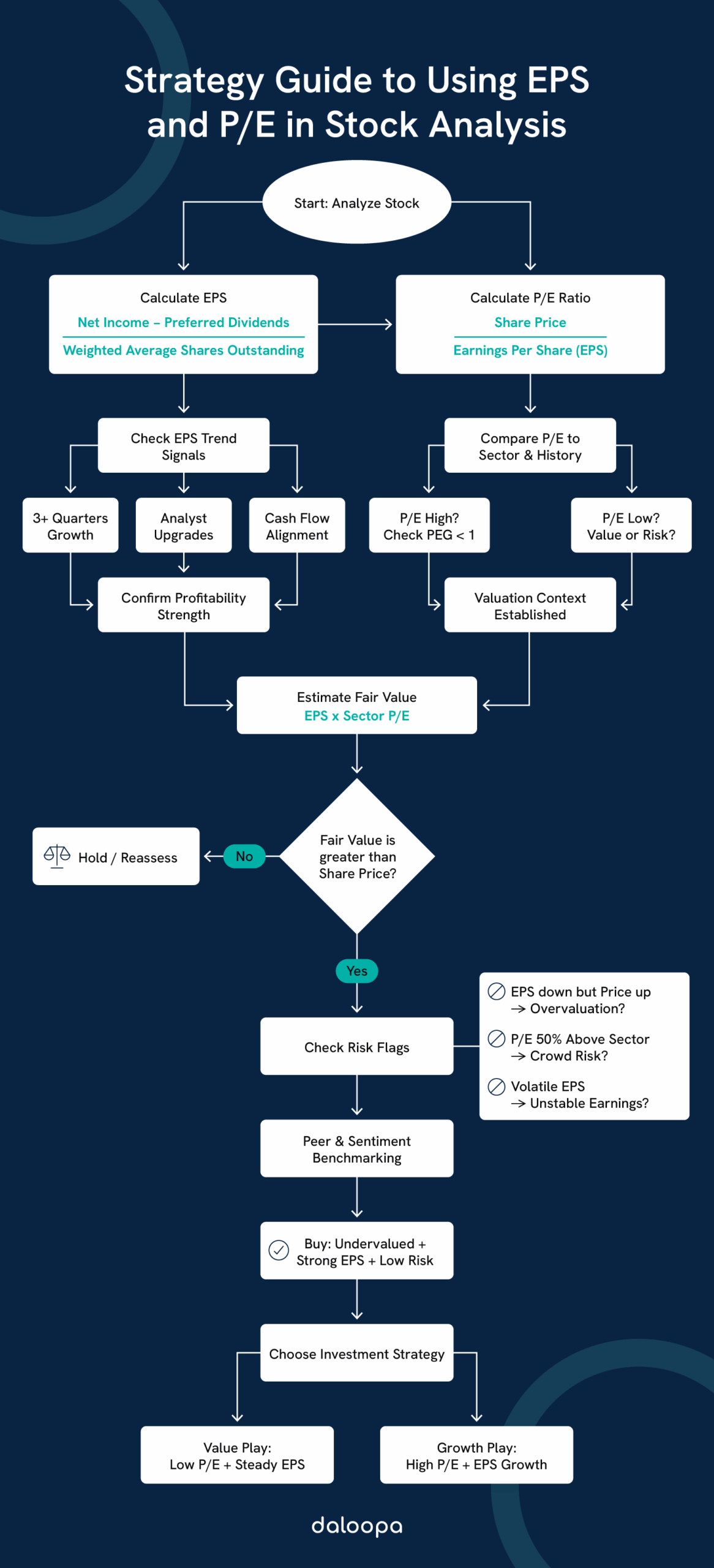

EPS measures how much net income each share of common stock earns after subtracting preferred dividends. You calculate it by dividing net income minus preferred dividends by the weighted-average shares outstanding. When EPS climbs, you’re seeing management execute profitably and reward shareholders.

Quick Framework: The 3 Signals to Confirm an EPS Trend

- Consistent Growth: Year-over-year EPS rises for at least three consecutive quarters.

- Analyst Upgrades: Majority upgrades on forward EPS estimates.

- Cash Flow Alignment: Operating cash flow increases alongside EPS.

This layered check moves you beyond raw numbers into actionable insight. It’s a core part of analyzing financial ratios with greater depth.

Defining Price-To-Earnings (P/E) Ratio

The P/E ratio shows what investors pay for $1 of a company’s earnings by dividing the current share price by EPS. It helps you compare valuations across firms, sectors, or time. High P/Es can signal growth expectations, while low ones may point to value—or underlying trouble.

However, a high P/E can also raise concerns about overvaluation or excessive optimism. While it may reflect genuine growth potential or durable competitive advantages (such as those seen in leading cloud providers), it’s important to carefully evaluate the company’s business context, industry norms, and future prospects when interpreting the P/E ratio.

How EPS and P/E Work Together

EPS and P/E don’t just sit side-by-side—they work in tandem, offering a combined lens to evaluate company performance and whether the current market price makes sense using robust financial ratios and metrics.

The P/E ratio is directly tied to EPS, and this relationship makes the valuation clearer. Take a stock priced at $40 with $2 EPS—its P/E is 20, meaning investors are paying 20 times earnings.

What that “20” means varies by sector. It might reflect bullish growth forecasts or a stock that’s just expensive. Lower ratios may hint at value or underperformance.

By flipping P/E to earnings yield (EPS divided by price), you compare stocks to bonds—e.g., a P/E of 15 implies a 6.7% earnings yield, making stocks look attractive when 10-year Treasuries yield 4%.

EPS and P/E in Different Market Conditions

In bull markets, P/E ratios often stretch as investors get optimistic. Stocks with growing EPS may trade at 30x earnings or more as markets lean into future growth.

Bear markets bring the opposite—compression. Even profitable companies can see P/E ratios dip to 10–15x as investor sentiment turns cautious.

Some sectors—like consumer staples—stay relatively stable. Others, like tech or biotech, may see their earnings multiples swing dramatically depending on macroeconomic factors.

That’s why tracking these metrics over time, rather than in isolation, is critical to understanding how investors value earnings under different conditions.

Using EPS and P/E for Investment Decisions

Both EPS and P/E serve as go-to metrics for figuring out whether a stock’s price reflects its performance. Investors use them together to assess current earnings strength and pricing.

Identifying Undervalued or Overpriced Stocks

P/E helps investors spot pricing disconnects. A company with a much lower P/E than its peers could be mispriced or facing specific risks worth unpacking.

You can estimate fair value by multiplying projected EPS by a sector’s average P/E. You might have an undervalued stock if that number exceeds the current price.

It’s also helpful to look at history. If a stock currently trades at 15x earnings but its five-year average is closer to 25x, it’s worth exploring whether sentiment has shifted unfairly.

This is where deeper analysis often pays off. What looks undervalued might be a turnaround story in the making—or a value trap requiring caution.

EPS and P/E as Risk Assessment Tools

Watching how EPS evolves over time can flag whether a company’s performance is steady or volatile. Steady increases suggest management is executing well.

A sky-high P/E might reflect optimism, but also risk. Stocks trading well above industry averages often face sharper pullbacks if earnings disappoint.

Use EPS trends as early warning signs:

- Signal 1: EPS falls while the stock price holds or rises (you pay more for less).

- Signal 2: P/E exceeds sector averages by 50%, flagging crowd-driven risk.

- Signal 3: Wild EPS swings quarter-to-quarter, indicating volatility.

When these signals emerge, dial back position size or hedge to protect against earnings disappointments.

EPS, P/E, and Market Sentiment

Investor confidence or skepticism can drive valuations even when the numbers tell a different story. EPS and P/E shift with that mood and are crucial for analyzing financial ratios in real-time.

Investor Expectations and Market Enthusiasm

Market mood often stretches P/Es beyond fundamentals. Even flat EPS can command lofty multiples when hype peaks—think meme stocks or biotech breakthroughs—only to retrace when reality sets in. You counterbalance this by checking consumer-sentiment indices or sell-side earnings revisions to gauge whether optimism rests on solid ground.

Benchmarking and Peer Comparison

P/E ratios become more meaningful in context. Looking at similar businesses helps determine if a company is priced fairly, or stands out, either positively or negatively.

What to factor in:

- Industry growth pace

- Competitive edge

- Business maturity level

- EPS consistency

Companies with solid, dependable EPS often support higher P/E ratios. But if a peer’s ratio is far higher or lower, it’s worth digging into why the market sees things that way.

A P/E much higher than the peer group can mean overenthusiasm—or deserved confidence. Either way, context sharpens the picture.

Advanced Insights: EPS and P/E in Growth and Value Investing

Both value and growth investors rely on EPS and P/E, though in different ways. One focuses on future potential, the other on present performance versus price.

Growth Prospects and Earnings Growth Potential

Growth investors tolerate higher P/Es when they see rapid EPS expansion. To moderate this, you apply the PEG ratio—P/E divided by expected EPS growth rate. A PEG below 1 indicates a reasonable price given growth; above one can signal overstretch or efficiency gaps in reinvestment (per Damodaran’s Corollary 2).

The PEG ratio comes in handy to check if a stock is worth the high multiple. Divide P/E by the expected growth rate. A PEG under 1 suggests a fair—or better—valuation.

It’s common for firms reinvesting earnings to have weaker EPS today, but strong potential ahead. Sectors like tech or healthcare often fall into this category.

The bigger the reinvestment in R&D or customer acquisition, the more forward-looking the EPS story becomes, creating both opportunity and risk.

Value Interpretation and Investment Strategy

Value investors hunt where P/Es lag EPS growth. You screen for names trading at 10×–15× P/E with 5%–15% EPS growth, balancing upside and bearing minimal downside. Industries like energy or manufacturing often hide these opportunities—fundamentals shine, but sentiment drags valuation down.

What stands out:

- P/E lower than peers

- Consistent 5–15% EPS growth

- Solid earnings base

- Tame downside exposure

These indicators are essential in analyzing financial ratios that reflect true business value beyond short-term price moves. Industries like energy or manufacturing tend to harbor value opportunities—companies doing well but priced modestly.

Building Confidence with EPS and P/E

By weaving together EPS trends, P/E multiples, and growth expectations, you craft a disciplined, data-driven framework for stock selection. You’ll know when to seize steady-profit names trading at fair multiples and when to steer clear of narratives inflated by sky-high P/Es.

Signs of growing trust:

- EPS ticking upward year-over-year

- P/E staying aligned with industry benchmarks

- Steady or growing dividend stream

- Positive ROI and other return metrics

Watching how EPS and P/E evolve over multiple years reveals trends short-term traders often miss. Companies that deliver both steady profits and disciplined pricing tend to earn trust over time.

Seasoned investors track these trends closely. When earnings and valuations grow in step, it’s usually a sign the business is delivering—and the market is paying attention.

Take Your Analysis Further with Daloopa

Supercharge your EPS and P/E playbook: tap Daloopa’s AI-driven earnings call parsing, live historical fundamentals, and seamless Excel add-in. Turn every valuation metric into an actionable edge so you can make decisions with clarity, not second-guessing. Try a free demo to learn how to unleash professional-grade precision on your next trade with Daloopa.