If your dividends aren’t growing faster than inflation, your future income is shrinking. The dividend growth rate (DGR) formula reveals which companies will keep boosting your purchasing power and which will leave you behind. Dividend-based valuation models break down if growth stops or reverses. By mastering DGR calculations, you turn raw dividend data into clear signals: you’ll spot companies that reliably raise payouts versus those that may cut dividends later.

Key Takeaways

- Dividend growth rate tracks the annual percentage rise in payouts and signals how consistently a company prioritizes shareholder income.

- Multiple methods—year-over-year, multi-year, and compound growth—reveal short-term momentum and long-term staying power.

- Growth metrics connect with valuation models and payout coverage so you can find stocks that outpace inflation while keeping balance sheets sound.

Defining Dividend Growth Rate

The dividend growth rate is simply the percentage change in dividend payments over a chosen period. It answers: How much did the company’s payout increase? To compute it, relate the current dividend per share (DPS) to the prior period’s DPS. Subtract the old DPS from the new DPS, divide by the old DPS, and convert to a percent. For example, if dividends were $1.00 last year and $1.10 this year, the DGR = ($1.10 – $1.00)/$1.00 = 0.10, or 10%. In formula form, it’s:

Dividend Growth Rate (yearly) = (Current DPS ÷ Previous DPS – 1) × 100%

This matches the standard definition of DGR. A positive DGR typically reflects growing cash flows and disciplined capital returns. Companies that raise dividends steadily usually have strong finances and confidence in future earnings.

In practical terms: A 10% dividend growth rate means your income from that stock grows 10% annually. If you reinvest those dividends, compounding accelerates wealth-building. If you spend them, your income stream keeps pace with—or ideally exceeds—rising living costs.

DGR can be measured on different time frames:

- Annual: Compare total dividends from one year to the next (year-over-year change).

- Multi-year (CAGR): Compute the compound annual growth rate over a 5–10 year span.

- Quarterly: Track payout changes from quarter to quarter, which can reveal seasonality or one-off effects.

According to Bureau of Labor Statistics data, inflation has averaged approximately 3% over recent decades. This establishes your baseline: dividend growth below 3% means your real income is declining. Growth of 5-6% annually provides meaningful purchasing power expansion over time.

Types Of Dividend Growth Measurements

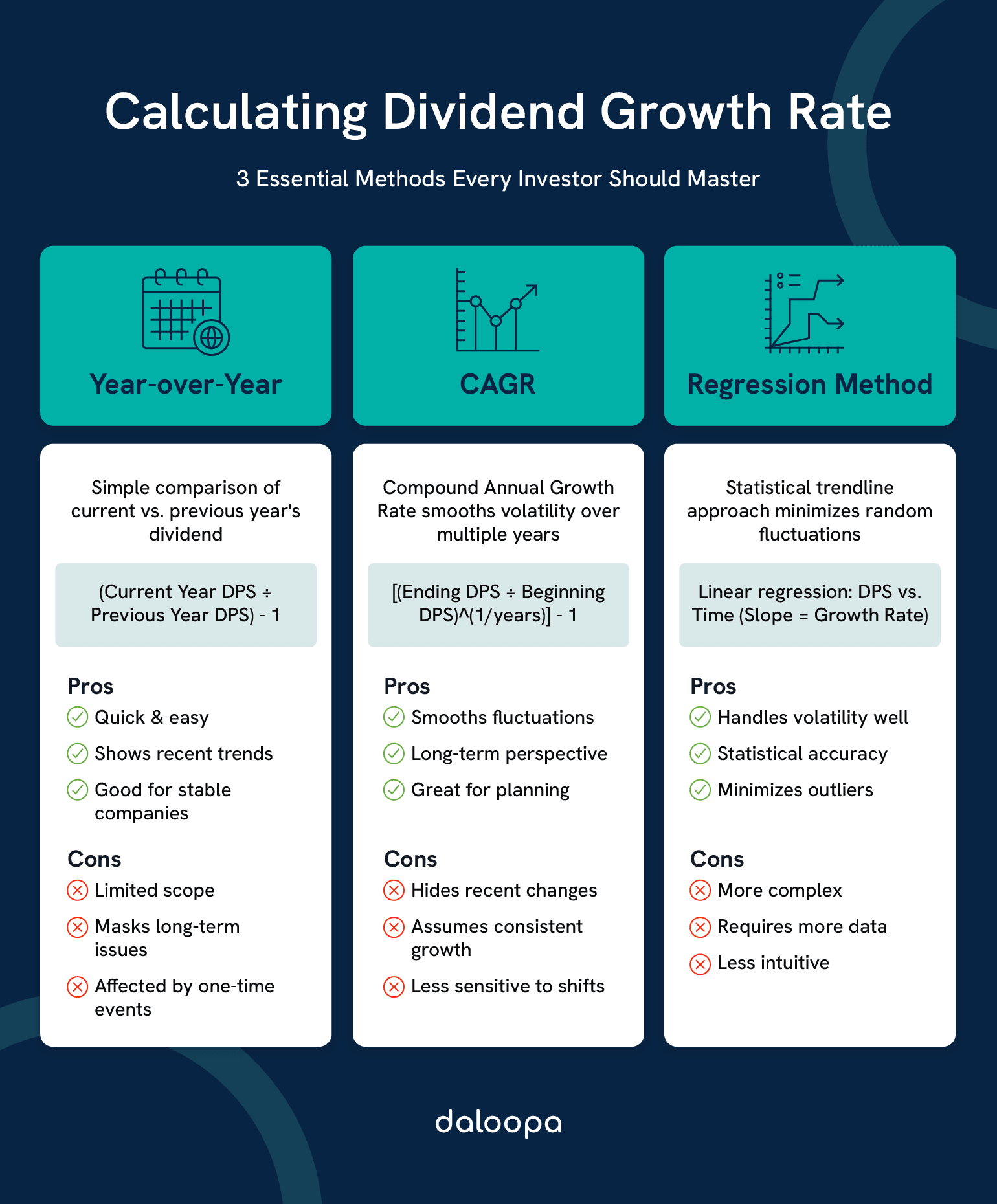

Investors look at dividend growth from several angles. Each method gives you a different lens on the data, which helps you validate trends or form expectations:

- Historical Growth Rate: This is the raw percent change based on actual past dividends. You directly compare DPS now versus DPS in past years. It shows exactly what management delivered. A long record of increasing dividends (e.g. 10+ years of raises) is a strong indicator of discipline. Consider the S&P 500 Dividend Aristocrats—companies that have increased dividends for 25+ consecutive years. Currently 69 companies meet this elite standard. Coca-Cola (KO) has raised dividends for 63 consecutive years with a 20-year CAGR of 6.67%, while Johnson & Johnson (JNJ) matches that streak with an even stronger 8.15% 20-year CAGR.

- Year-over-Year (YoY) Growth: This is the percent change from the dividend paid in one year to the next. It’s useful for spotting recent shifts. For example, if a business spun off an asset or completed a big project, you might see a one-year jump or drop.

- Compound Annual Growth Rate (CAGR): This smooths out the ups and downs by taking the multi-year growth and averaging it geometrically. Use CAGR when you care about the long-term trend (say a 5- or 10-year horizon). The formula is [(Ending DPS ÷ Beginning DPS)^(1/years)] – 1. For example, if dividends went from $1.50 five years ago to $2.43 today, CAGR = [(2.43/1.50)^(1/5)] – 1 ≈ 10.1%. In plain terms: “Dividends grew about 10% per year, on average.”

- Expected Future Growth: These are forward-looking estimates. Analysts may forecast dividend growth based on earnings projections, expected payout ratio changes, or company guidance. Some investors also infer “market-expected” growth rates by looking at dividend futures or stock option prices.

- Dividend Discount Model (DDM) Implied Growth: Rather than observing payouts, some valuation formulas impute a growth rate from price. For instance, if a stock is trading at a certain yield and you back out the growth that makes the present-value-of-dividends equal the price.

- Dividend Yield Growth: Instead of focusing on DPS alone, this tracks how the dividend yield changes over time, reflecting both payout increases and stock price moves. Yield growth combines dividend hikes (higher DPS) and price fluctuations (which inversely affect yield).

Calculating Dividend Growth Rate

Once you know the methods, you apply them via a few core techniques. Each has its strengths, and you should use all of them to cross-check your work.

Let’s examine each method in detail, starting with the simplest approach:

Year-Over-Year Method

This is the simplest quick check. You divide the current year’s dividend by last year’s, subtract 1, and express it as a percentage.

Formula: (Current Year Dividend ÷ Previous Year Dividend) – 1 = Growth Rate

For example, if the company paid $2.00 per share last year and $2.20 per share this year, then DGR = $(2.20/2.00) – 1 = 0.10$, or 10% growth. This single figure tells you instantly if current policy is up or down. In practice, it suits companies with steady, predictable payouts (like consumer staples or utilities). You’ll know immediately if a dividend just went up, stayed flat, or got cut.

What this means for you: A single-year 10% increase tells you management is committed right now, but doesn’t confirm sustainability. Always verify with longer-term measures to distinguish genuine growth from temporary catch-up.

However, beware its narrow focus: a one-year increase can mask problems. For instance, a company could have cut its dividend two years ago and is just catching up now; the 10% might look good, but it may still be playing catch-up. Or a single large one-time payout (from asset sales, say) could spike the percentage but won’t repeat. Always confirm YoY results with longer-term measures.

Compound Annual Growth Rate (CAGR) Method

CAGR gives you the average annual growth rate over several years. It accounts for compounding and smooths out volatility.

Formula: [(Ending Dividend ÷ Beginning Dividend)^(1/Number of Years)] – 1

Choose a horizon that matches your analysis (often 5–10 years). For example, if dividends were $1.50 five years ago and $2.43 today, calculate $\bigl(2.43/1.50\bigr)^{1/5} – 1 \approx 10.1%$. In plain terms, dividends grew about 10% per year, compounded.

In practical terms: A 10% CAGR over 5-10 years signals consistent management discipline and sustainable earnings growth. However, if this dividend CAGR consistently exceeds earnings growth over the same period, the company may be overextending—raising the payout ratio to unsustainable levels. Cross-check dividend growth against EPS growth to validate sustainability.

Besides measuring growth, CAGR can be plugged into valuation and planning models. It acts as a “flat growth rate” assumption if you believe the past 5–10 years are representative of the future. Remember, the longer the period, the more it filters out noise, but also the more it smooths short-term changes.

Least Squares Regression Method

A more advanced approach is to fit a trendline through historical dividends. Statistically, this means using least-squares linear regression on DPS vs. time. The slope of the best-fit line indicates the implied growth rate. In practice, put annual DPS on the vertical axis and year on the horizontal, run a linear regression, and the slope (converted to a percentage) is your annual growth.

Why use this? It’s helpful when dividends had stops, spikes or cuts. Regression minimizes the effect of random fluctuations or one-off jumps. For example, if a company added a special dividend one year, or missed a payment another year, the regression line will smooth these out, giving you the “central tendency.” It’s also useful paired with an earnings regression: by comparing the slopes for dividends and EPS, you can see if dividends have been growing faster than earnings (a dangerous sign).

What this reveals: Regression analysis cuts through noise to show the underlying trend. If the trendline suggests 5% annual growth but actual dividends jumped 15% last year, you know that jump likely won’t repeat. Budget conservatively using the trendline rate.

Applying Dividend Growth In Valuation Models

Dividend growth sits at the core of cash-flow-based valuation for income stocks. These models help you compare market price with intrinsic value and judge whether current policy can persist across your holding period.

Dividend Discount Model (DDM)

The dividend discount model values a stock by discounting future dividends to today’s dollars. Growth assumptions matter because they shape the stream you’re valuing.

The Gordon Growth version uses: Stock Value = Next Year’s Dividend ÷ (Required Return – Growth Rate). If a company pays $2.00 annually, grows 5%, and your required return is 10%, the implied value is $42.00.

In practical terms: If the stock trades at $35 when your DDM calculates $42 fair value, it may be undervalued. If it trades at $50, it may be overpriced. This model is most reliable for mature, stable dividend payers—it breaks down for high-growth companies or those with erratic payouts.

Multi-stage DDM models better reflect real business patterns. They allow faster growth for a time, then taper toward a mature rate as markets saturate or reinvestment opportunities narrow.

| Stage | Typical Duration | Growth Characteristics |

| High Growth | 5–10 years | Above-average expansion |

| Transition | 3–5 years | Decelerating growth |

| Mature | Perpetual | Stable, sustainable pace |

By assigning different growth rates to each stage, you anchor assumptions to business reality rather than a single, perpetual rate.

The Vanguard Dividend Growth Fund (VDIGX) applies these principles institutionally, targeting companies capable of growing dividends at inflation plus 3 percentage points. With $47.5 billion in assets and 10-year returns of 10.24%, the fund demonstrates how dividend growth analysis translates into long-term outperformance.

Dividend Growth Sustainability Analysis

Growth rates are only as good as the cash that funds them. For long-term investment decisions, test whether policy fits the firm’s economics so shareholders aren’t surprised by a freeze or cut.

Start with the payout ratio: dividends per share divided by earnings per share. According to Hartford Funds’ 94-year historical analysis, the optimal payout ratio clusters around 40-41%, corresponding to 2.4x earnings coverage. Ratios near or above 80% for extended periods often indicate limited room for continued increases—research from Breckinridge Capital found that 60% of dividend cuts came from the highest payout ratio cohort.

Then check coverage ratios to validate safety:

- Earnings coverage: Earnings per share ÷ Dividends per share

- Free cash flow coverage: Free cash flow per share ÷ Dividends per share

Names with shrinking coverage may struggle to keep hiking. Flag cases where earnings coverage falls below ~1.5x or free cash flow coverage below ~1.2x for closer review.

Why these thresholds matter: Charles Schwab research warns that payout ratios “creeping above 80%” signal companies may lack cushion to invest in growth or weather downturns. A 1.5x coverage ratio equals approximately 67% payout, approaching the danger zone. Below these levels, you should expect:

- Dividend freezes: Management may pause increases to rebuild coverage ratios.

- Dividend cuts: If earnings decline further, maintaining the dividend becomes unsustainable (see AT&T case below).

- Capital allocation shifts: Companies may redirect cash toward debt reduction or acquisitions rather than dividend growth.

- Slower growth rates: Even if maintained, future increases will likely drop from 8-10% annually to 2-3%.

AT&T provides a sobering example. The telecom giant maintained high dividends (6.5-7.7% yield) while accumulating $180 billion in debt from failed media acquisitions. When the strategy collapsed, AT&T slashed its dividend 46.6% in April 2022—from $2.08 to $1.11 annually—to establish a more sustainable 40% payout ratio. The dividend has remained flat since, with no growth for over three years. High current yield often signals underlying business problems, not opportunity.

Context matters by industry. Utilities commonly run higher payout ratios than tech firms because capital intensity and growth paths differ. According to industry research, utilities average 65% payout ratios versus the universal 35% average, targeting 50-60% as optimal given stable cash flows and regulated returns. Technology companies typically maintain 20-30% payouts given R&D reinvestment needs.

Tracking these metrics across your portfolio manually is time-consuming. Daloopa’s financial modeling platform automatically calculates payout ratios, coverage metrics, and historical trends from company filings, with updates delivered within minutes of each earnings release. This enables continuous monitoring rather than quarterly spot-checks.

Practical Applications For Investors

Once you can compute and interpret DGR and related metrics, you can put them to work in your portfolio strategy:

For Retirees Drawing Income

If you’re already retired and depending on dividend income to cover living expenses, dividend growth analysis serves a defensive purpose—protecting purchasing power against inflation.

Your priorities:

- Immediate yield matters because you need cash flow now, but don’t chase yields above 6-7% (often signals trouble).

- Consistent growth of 3-5% annually maintains purchasing power as prices rise.

- Payout ratios below 70% provide cushion against dividend cuts that would force lifestyle adjustments.

- Focus on Dividend Aristocrats or established blue-chips with 20+ year track records.

Example scenario: A retiree with a $1 million portfolio generating $40,000 annually (4% yield) needs dividend growth to match inflation. Without growth, that $40,000 buys only $29,600 worth of goods after 10 years at 3% inflation. With 5% dividend growth, income reaches $65,200 after 10 years—maintaining and improving purchasing power.

Actionable steps:

- Screen for companies with 15+ year dividend growth streaks using S&P Dividend Aristocrats list.

- Verify payout ratios remain below 70% in company 10-K filings.

- Diversify across 20-30 holdings to protect against individual cuts.

- Rebalance annually, replacing companies that freeze dividends.

For Younger Investors Reinvesting Dividends

If you’re in accumulation mode with decades until retirement, dividend growth compounds your wealth at an accelerated rate through reinvestment.

Your priorities:

- Growth rate matters more than current yield because reinvestment multiplies the effect.

- Target 7-10% annual dividend growth to significantly outpace inflation.

- Accept lower current yields (1.5-3%) on faster-growing companies.

- Longer evaluation periods (10+ years) better predict future patterns.

Example scenario: A 35-year-old investor puts $50,000 into dividend stocks yielding 2% with 8% annual dividend growth. Over 30 years with dividends reinvested, this grows to approximately $445,000 (assuming flat share prices). The same investment in a 5% yielder with no growth reaches only $216,000. The difference? Compounding dividend growth creates an additional $229,000.

Actionable steps:

- Calculate 10-year dividend CAGR for candidates, targeting 7%+ growth.

- Compare dividend CAGR to earnings CAGR—dividend growth should not exceed earnings growth.

- Focus on companies with payout ratios below 50% (room to grow).

- Use Daloopa’s modeling tools to project future dividend growth scenarios.

- Automatically reinvest through dividend reinvestment plans (DRIPs).

Valuation and Screening

Use your growth estimates in a DDM to flag bargains or overvaluations. For instance, if your DDM suggests fair value is $50 but the market price is $40, the stock may be undervalued.

- Calculate historical 5-year and 10-year dividend CAGR.

- Project conservative future growth (typically 70-80% of historical rate).

- Determine required return based on your risk tolerance (typically 8-12%).

- Apply Gordon Growth Model: Fair Value = Next Year Dividend ÷ (Required Return – Growth Rate).

- Compare to current market price—look for 20%+ discount to fair value.

Portfolio Construction

Blend stocks with different growth/yield profiles to match your income goals. If you need immediate cash (e.g. a retiree drawing income), you may focus on established high-yielders with moderate growth (like utilities or Dividend Aristocrats).

Consider a tiered strategy:

- Core holdings (60%): Dividend Aristocrats with 3-5% yields and 4-6% growth

- Growth sleeve (30%): Lower-yielding (1.5-2.5%) but faster-growing (8-10%) dividend payers

- High-yield sleeve (10%): Stable 5-7% yielders for immediate income, even with slower growth

Ongoing Monitoring

Dividend policies can change. A steady 5% raise streak can end if business conditions worsen. Update your calculations whenever new financials come out. Recompute DGR, payout and coverage each quarter.

Red flags requiring immediate review:

- Dividend growth rate drops below inflation for two consecutive quarters

- Payout ratio exceeds 75%

- Earnings coverage falls below 1.5x

- Free cash flow turns negative

- Management discusses “evaluating capital allocation strategy” in earnings calls

- Debt-to-EBITDA ratios exceed 3.0x (indicates dividend may be sacrificed to preserve credit ratings)

Keep in mind why growth matters. Without it, inflation erodes your dividends’ value. With inflation averaging 3% annually, $10,000 of dividend income today will only buy about $7,400 worth of goods in 10 years if dividends don’t grow. That’s a 26% loss in purchasing power—like taking a pay cut every single year. Dividend growth isn’t optional; it’s essential for maintaining your standard of living.

Supercharge Your Dividend Research with Daloopa

Building comprehensive dividend growth models requires historical data across multiple timeframes, continuous monitoring of payout ratios and coverage metrics, and instant updates when companies report earnings. Doing this manually for even 10-20 stocks consumes hours each week.

Daloopa’s AI-powered platform automatically gathers the data you need—historical dividends, EPS, cash flow, payout ratios, and more—for thousands of companies. Every figure in your model links back to the SEC filings, and updates arrive within minutes of each earnings release. That means you spend time analyzing rising payouts and screening for inflation-beating stocks, not hunting down old 10-Ks or manually updating spreadsheets.

Key features for dividend analysis:

- Pre-built financial models with 10+ years of dividend history already standardized, powered by AI-driven technology that updates data within minutes of SEC filings, cutting manual update time from hours to a single click.

- Export to Excel for custom analysis and portfolio tracking, or use Daloopa’s Excel add-in to pull live data directly into your existing models.

- Automatic calculation of payout ratios, coverage metrics, and growth rates across your portfolio, with instant industry comparisons to benchmark dividend sustainability against sector peers—eliminating hours of manual aggregation.

- Instant alerts when companies announce dividend changes through live update notifications.

Give Daloopa a spin and see how fast you can turn raw financials into confident dividend-growth insights.