Meta’s FQ4 earnings report beat across the board with revenue growing 21% year over year but more impressive was the sharp beat on operating margins as they reached a 7-year high of 48% blowing away the Street estimates by 600bps. The strong showing was somewhat offset by the albeit pre-announced elevated 2025 capex of $60-65 billion up an astounding 68% year over year. Zuckerberg did not stray from his aggressive investments in capex despite the recent Deep Seek revelation, using it more as a rallying cry toward Llama being the open-source standard globally.

Margin upside was primarily from the core Family of Apps, which notched a near 60% Operating Margin (59.9% to be exact). Reality Labs pitched in by narrowing its cash bleed slightly (about $400-500 million less than expected), albeit still a considerable drag on overall operating cash flow as it lost nearly $5 billion for the quarter. Free cash flow blew away expectations at $13.5 billion (vs. the $9 billion consensus), while capex remained elevated at $14.4 billion for the quarter.

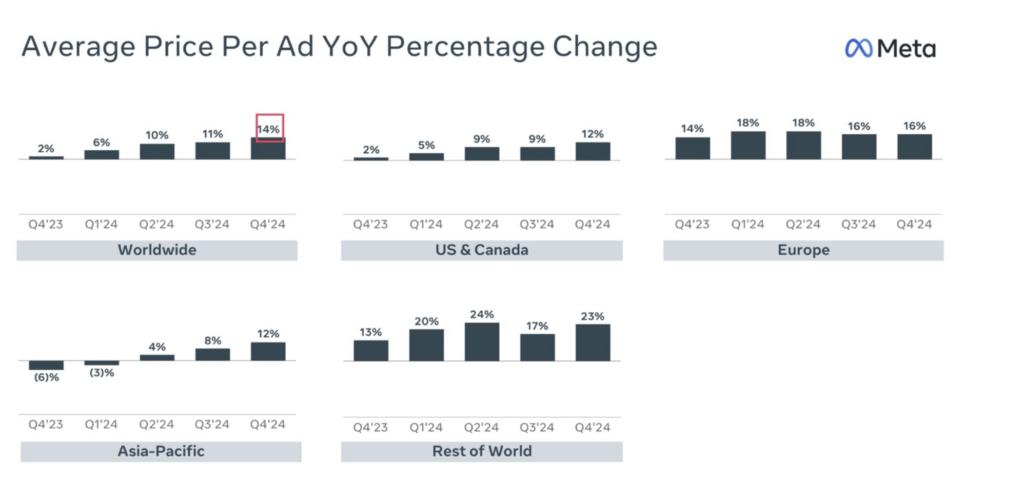

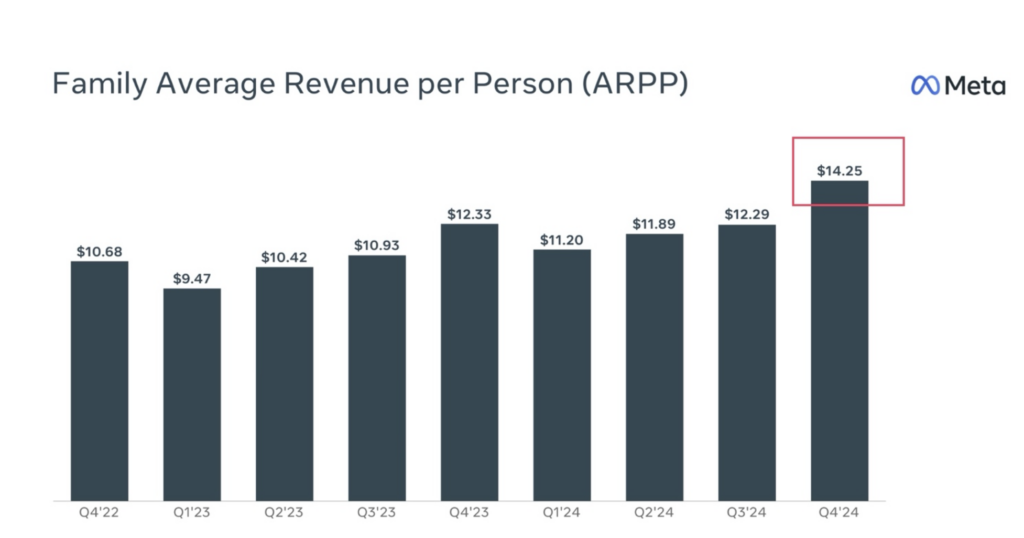

The upside came from pricing as the average price per ad increased 14% year over year. As seen in the chart above, growth was seen in all geographies. Ad impression growth continued to decelerate to 6% year over year from 7% last quarter. All in, ARPP increased to a new all-time high of $14.25, as seen in the chart below.

Outside of the outsized capital investments in building data center capacity, META’s job at cost containment has been stellar. Outside of R&D growing 16% year over year, S&M and G&A (excluding the large benefit from the reduction in legal accruals) were basically flat year over year. META is also benefitting already from previous ML investments, as Zuckerberg stated on the call-

In the second half of 2024, we introduced an innovative new machine learning system in partnership with Nvidia, called Andromeda. This more efficient system enabled a 10,000x increase in the complexity of models we use for ads retrieval, which is the part of the ranking process where we narrow down a pool of tens of millions of ads to the few thousand we consider showing someone. The increase in model complexity enables us to run far more sophisticated prediction models to better personalize which ads we show someone. This has driven an 8% increase in the quality of ads that people see on objectives we’ve tested. Andromeda’s ability to efficiently process larger volumes of ads also positions us well for the future as advertisers use our generative AI tools to create and test more ads.

Net Takeaway

META delivered a very impressive quarter in terms of growth, cost containment and cash generation. Investors must wrestle with the huge investment in AI as it offsets the incredible free cash flow generation of the company, but they firmly believe it will provide them a massive strategic competitive advantage in the years ahead. With the stock trading at 18x EV/EBITDA and 31.5x EV/FCF (2025), valuation seems fairly full but not unreasonable for one of the biggest potential beneficiaries of the AI Revolution.