RIVN Investor Relations

Get all historical data on Rivian Automotive

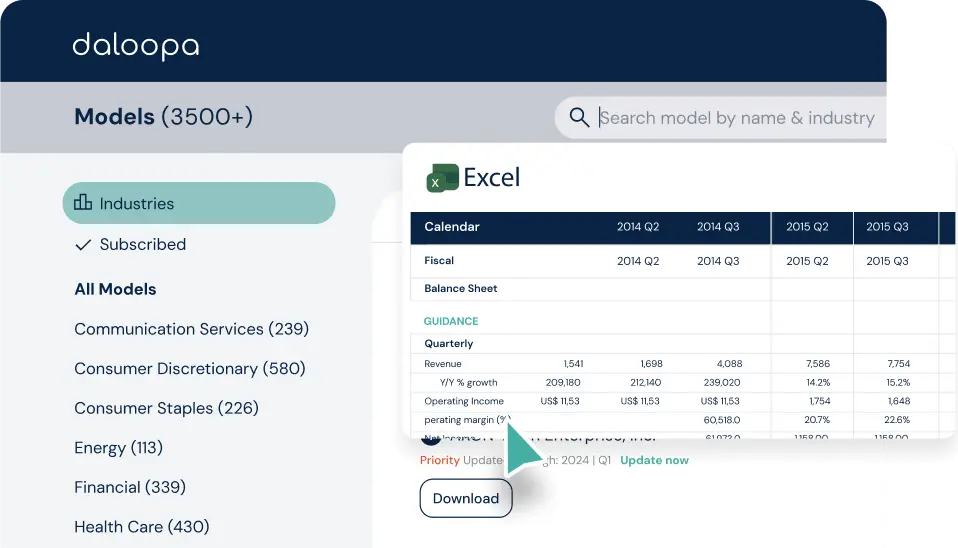

Stop wasting time on manual entry and start making faster, smarter decisions with accurate, up-to-date RIVN numbers you can trust.

- Deep dive into the latest Rivian Automotive earnings data, including segmental KPIs, GAAP to Non-GAAP, Guidance, Adjustments and more.

- Access the original source file in one click with hyperlink technology on every single data point.

- Use the data how you want it with our flexible delivery format.

Download now and get the data you need to stay ahead.

Get all the historical Rivian Automotive fundamental data in one place with the Daloopa Data Sheet.

Rivian Automotive SEC Filings & Financial Statements Last 5 Years

2024 Earnings

2024 - Q4

2024 - Q3

2024 - Q2

2024 - Q1

2023 Financial Disclosures

2023 - Q4

2023 - Q3

2023 - Q2

2023 - Q1

2022 Financial Disclosures

2022 - Q4

2022 - Q3

2022 - Q2

2022 - Q1

2021 Financial Disclosures

2021 - Q4

2021 - Q3

Rivian Automotive Investor Relations Presentation

Rivian Automotive, Inc. is an American electric vehicle (EV) manufacturer specializing in adventure-oriented trucks and SUVs. The company offers the R1T pickup truck and the R1S SUV, both designed for on-road and off-road performance. Rivian also produces electric delivery vans for commercial clients, notably Amazon. The company’s mission is to accelerate the transition to sustainable transportation.

Rivian Automotive Head of Investor Relations

As of November 2024, Rivian Automotive’s Vice President of Investor Relations and Strategic Finance is Tim Bei. He oversees communication with investors and stakeholders, providing updates on the company’s financial performance and strategic direction.

Rivian Automotive Investor Relations Email & Contact Us

For inquiries related to investor relations, interested parties can contact Rivian’s investor relations team via email at ir@rivian.com. Additionally, media inquiries can be directed at media@rivian.com

RIVN Last Stock Split

As of now, Rivian Automotive has not conducted any stock splits since its initial public offering (IPO) on November 10, 2021. The company continues to trade under the ticker symbol RIVN on the Nasdaq Global Select Market.

RIVN Investor Relations Website

Rivian’s dedicated investor relations website can be found at rivian.com/investors. This platform provides comprehensive information regarding financial results, upcoming events, shareholder communications, and other relevant updates for investors and analysts.

Covering more companies?

Create a free account to access up to 5 free data sheets.

Daloopa is your gateway to the latest data during earnings, including KPIs, guidance, GAAP to Non-GAAP and more, all formatted for immediate use.

Are you ready to stop wasting time on manual entry and start making faster, smarter decisions with accurate, up-to-date numbers you can trust? Create your free account today and get the data you need to stay ahead.

Create Free Account

About Daloopa

We believe that AI technology can improve clarity and efficiency for investors and financial markets.

Daloopa was formed in 2019, inspired by our founders’ personal experience at Point72, a NYC- based/short equiy hedge. Accurate data is central to all investment decisions and can influence speed and confidence for decision-makers. We believe that institutional finance has an opportunity to embrace tech-driven accuracy and speed.