SMCI Investor Relations

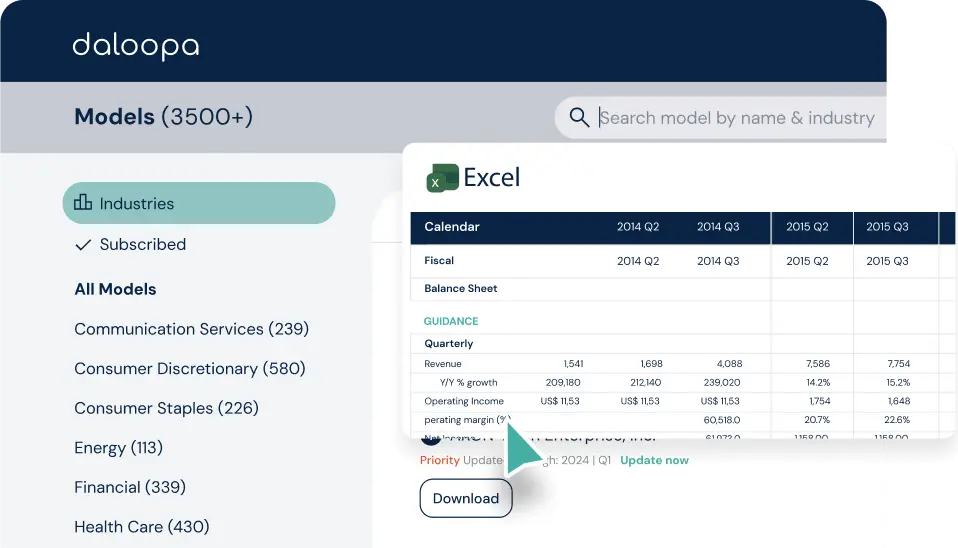

Get all historical data on Super Micro Computer

Stop wasting time on manual entry and start making faster, smarter decisions with accurate, up-to-date SMCI numbers you can trust.

- Deep dive into the latest Super Micro Computer earnings data, including segmental KPIs, GAAP to Non-GAAP, Guidance, Adjustments and more.

- Access the original source file in one click with hyperlink technology on every single data point.

- Use the data how you want it with our flexible delivery format.

Download now and get the data you need to stay ahead.

Get all the historical Super Micro Computer fundamental data in one place with the Daloopa Data Sheet.

Super Micro Computer SEC Filings & Financial Statements Last 5 Years

2024 Earnings

2024 - Q4

2024 - Q3

2024 - Q2

2024 - Q1

2023 Financial Disclosures

2023 - Q4

2023 - Q3

2023 - Q2

2023 - Q1

2022 Financial Disclosures

2022 - Q4

2022 - Q3

2022 - Q2

2022 - Q1

2021 Financial Disclosures

2021 - Q4

2021 - Q3

2021 - Q2

2021 - Q1

2020 Financial Disclosures

2020 - Q4

2020 - Q3

2020 - Q2

2020 - Q1

2019 Financial Disclosures

2019 - Q4

2019 - Q3

2019 - Q2

2019 - Q1

Super Micro Computer Investor Relations Presentation

Super Micro Computer, Inc. (SMCI) is a global leader in application-optimized IT solutions for enterprise, cloud, artificial intelligence (AI), and 5G Telco/Edge infrastructure. For over 30 years, the company has provided next-generation, sustainable IT solutions, including its Building Block Solutions® and Green Computing servers.

Super Micro Computer Head of Investor Relations

The Vice President of Investor Relations at Super Micro Computer is James Kisner, CFA.

Super Micro Computer Investor Relations Email & Contact Us

For investor relations inquiries, you can contact Super Micro Computer via email at ir@supermicro.com.

For general inquiries, Super Micro Computer’s headquarters are located at:

980 Rock Ave. San Jose, CA 95131, USA

You can reach them by phone at +1 (408) 503-8000 or via email at Marketing@Supermicro.com.

SMCI Last Stock Split

Super Micro Computer executed a 10-for-1 stock split on October 1, 2024. This means that each existing share was divided into ten shares, reducing the stock price proportionally while maintaining the overall market capitalization.

SMCI Investor Relations Website

For more detailed information, including financial reports, news, and events, visit Super Micro Computer’s Investor Relations website: https://ir.supermicro.com/ir-overview

Covering more companies?

Covering more companies?

Create a free account to access up to 5 free data sheets.

Daloopa is your gateway to the latest data during earnings, including KPIs, guidance, GAAP to Non-GAAP and more, all formatted for immediate use.

Are you ready to stop wasting time on manual entry and start making faster, smarter decisions with accurate, up-to-date numbers you can trust? Create your free account today and get the data you need to stay ahead.

Create Free Account

About Daloopa

We believe that AI technology can improve clarity and efficiency for investors and financial markets.

Daloopa was formed in 2019, inspired by our founders’ personal experience at Point72, a NYC- based/short equiy hedge. Accurate data is central to all investment decisions and can influence speed and confidence for decision-makers. We believe that institutional finance has an opportunity to embrace tech-driven accuracy and speed.