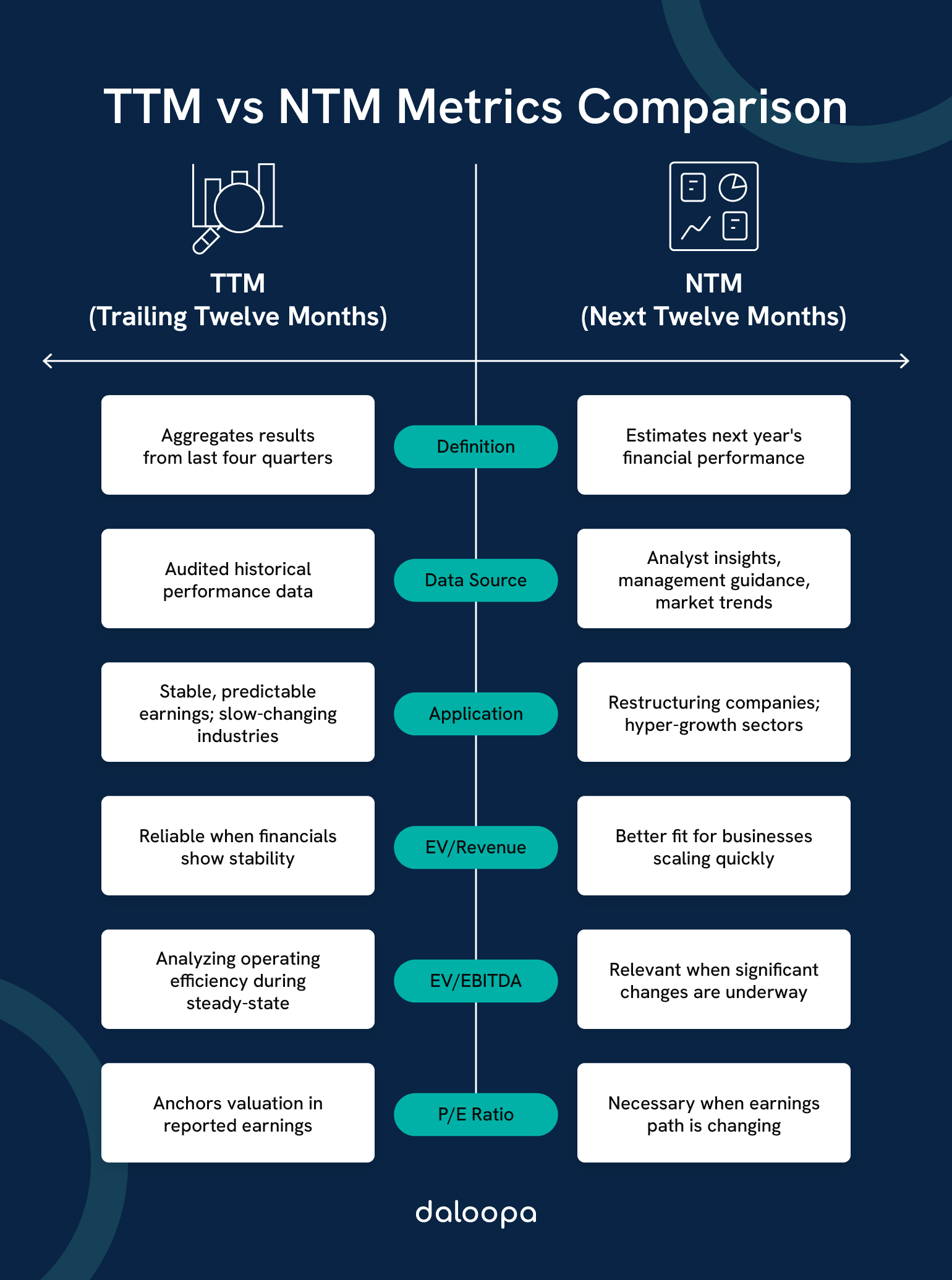

When you weigh past performance against future potential, choosing between Trailing Twelve Months (TTM) and Next Twelve Months (NTM) metrics can make or break a valuation, especially when market dynamics shift faster than quarterly reports roll in. The choice leans heavily on how stable or dynamic market conditions are—TTM offers a firm snapshot of past performance, while NTM delivers insight into what’s coming next, especially for fast-moving sectors.

Key Takeaways

- TTM reflects confirmed past performance, which is ideal when market dynamics are relatively steady.

- NTM projects where a company’s headed, capturing forward-looking momentum.

- Use each metric in context—tie your choice to the company’s industry, maturity, and forecast reliability.

Understanding Time Horizons In Financial Metrics

Every valuation hinges on how you frame time. You can dig into what’s already happened or take a hard look at what’s coming; each horizon tells a very different story.

Defining TTM (Trailing Twelve Months)

TTM aggregates a company’s financial results for the most recent four quarters, giving you a full 12-month view that smooths seasonality and one-off anomalies. You calculate TTM by adding the latest quarterly results to the previous fiscal year and subtracting the comparable quarter from the prior year—for example:

TTM Revenue = Q1’25 + FY’24 – Q1’24

This backward-looking approach anchors you in audited data, making it ideal when you need defensible, fact-based multiples—especially in cyclical industries like manufacturing or retail, where holiday and back-to-school swings can otherwise mislead your valuation and analysis techniques.

Defining NTM (Next Twelve Months)

NTM projects financial metrics—revenue, EBITDA, EPS—over the coming twelve months based on analyst consensus, management guidance, and market trends. You might see it expressed as:

NTM EBITDA = Forecasted Revenue × Estimated EBITDA Margin

Use NTM when you’re valuing a SaaS provider onboarding enterprise clients next quarter or a biotech awaiting FDA readout in six months. By incorporating forward-looking indicators, NTM captures strategic inflections, though it also introduces forecast risk, so you must rigorously stress-test your growth and margin assumptions against historical management accuracy.

Why Both Matter in Financial Metrics Comparison

Ultimately, neither horizon holds all the answers—TTM grounds you in reality, while NTM projects what could be. By understanding what each time frame reveals—and hides—you’ll choose the one that aligns with your company’s growth profile, industry dynamics, and the reliability of your forecasts.

Core Applications In Valuation

You’ll see both metrics pop up in IPO roadshows, M&A diligence, and peer comps. Their relevance depends on how much the past aligns with the future, a vital part of any financial metrics comparison.

- Stable Industries (e.g., Utilities, Consumer Staples): TTM multiples like EV/EBITDA give you a defendable base. You avoid overpaying when growth stalls.

- High-Growth Sectors (e.g., SaaS, Biotech): NTM multiples capture pipeline deals or trial results. Think of a SaaS firm planning its first overseas expansion—last year’s numbers won’t tell that story.

- Transitional Businesses: Use both. Anchor with TTM, then layer on NTM to reflect strategic shifts (reorgs, new leadership, pivoting business models).

Theoretical Foundations

Valuation theory blends historical anchoring with forward-looking insights.

- Efficient Market Hypothesis tells us that “known” and “anticipated” information both drive prices.

- Modern Portfolio Theory pushes you to consider future volatility and correlations—something NTM is built to integrate.

Micro-case: Imagine you’re valuing a cleaning company, which just secured a government contract to build 500 MW of solar farms. TTM EV/EBITDA ignores that deal—NTM incorporates it. Missing that, you’d underprice at-risk cash flows.

Valuation theory blends historical anchoring (TTM) with forward-looking insights (NTM). From the Efficient Market Hypothesis to Modern Portfolio Theory, both metrics play a crucial role in advanced valuation and analysis techniques.

Comparative Analysis Of TTM And NTM Multiples

Valuation multiples translate earnings and revenue into price benchmarks. How you choose your horizon affects every downstream assumption.

EV/EBITDA Applications

- TTM EV/EBITDA suits cyclical industries (manufacturing, energy). It smooths seasonal swings.

- NTM EV/EBITDA matters when operational changes are imminent (cost cuts, margin improvements). A consumer goods firm cutting COGS by 200 bps next quarter deserves forward multiples.

A widening spread between TTM and NTM EV/EBITDA often flags investor optimism—or concern—about near-term margin shifts.

P/E Ratio Considerations

- TTM P/E anchors you in real, reported earnings—critical during downturns.

- NTM P/E is indispensable when growth accelerates (e.g., a biotech awaiting FDA approval).

Decision Framework For Selecting Appropriate Time Horizons

You’ve got to step back and evaluate how much past performance will predict the future. Here’s how to build your decision tree:

Company-Specific Factors

High-growth businesses—especially those in tech or SaaS—often see revenue and margins shift quickly. For them, NTM is more reflective of where they’re headed than what they’ve already done.

More established businesses with steady margins and customer bases usually fit TTM models better. The past 12 months offer a reliable guide to likely future performance.

Key Internal Variables to Consider:

- Predictability of revenues and seasonality trends

- How fast market share is expanding or contracting

- Recent structural changes (like mergers or reorgs)

- Whether management forecasts have historically been accurate

- Impact of fixed versus variable costs on earnings

Industry And Market Dynamics

- Cyclical sectors (automotive, materials): rely on TTM to smooth short-term swings.

- Disruptive sectors (clean energy, enterprise software): lean on NTM to capture innovations.

Sector-Specific Considerations:

- How quickly innovation changes product relevance

- Exposure to tech-based disruption

- Reliability of suppliers and shipping

- Regulatory shifts that affect pricing power

- Revenue dependence on a few large buyers

Macroeconomic Influences

- Interest rates. In high-rate environments, TTM avoids overestimating growth; when rates fall, NTM may drive upside.

- Inflation and credit cycles. Use TTM to anchor during volatile times.

Risk Adjustment Factors:

- Sensitivity to market-wide movements (beta)

- Currency risk tied to global operations

- Breadth of geographic revenue streams

- Inflation pressure on cost structures

- Tightness in credit and lending markets

Practical Implementation Strategies

Putting theory into practice means adopting structured methods and communicating clearly.

Blended Approaches

- Adjusting NTM/TTM weights by forecast reliability: Use 40/60 for stable earnings, 70/30 for high-growth or strong guidance.

- Quarterly updates: Compare each quarter’s actuals to your NTM forecasts—adjust your weighting if errors exceed 5%.

- ROIC stress tests: Track TTM vs. forward ROIC to validate assumptions.

Industry-Specific Best Practices

| Sector | Primary Focus | Secondary Focus |

| Technology | NTM revenue & product KPIs | TTM cost structure |

| Industrial | TTM ROIC & capex | NTM margin forecasts |

| Consumer Goods | TTM margin stability | NTM volume trends |

Stakeholder Communication

- Side-by-side dashboards: Always show TTM vs. NTM in your pitch decks.

- Assumption callouts: Highlight key drivers—e.g., “We assume a 25% increase in subscription ARPU by Q2”—and attach version-controlled model notes.

- Example scenario: Frame bullet points like “If retention dips to 85%, NTM EV/Revenue falls by 2x.”

Ignite Your Valuation Edge

By mastering TTM and NTM, you control the narrative: you anchor valuations in reality while unlocking future upside. Whether your focus is on financial metrics comparison or using advanced valuation and analysis techniques, these metrics are your edge. You’ll manage risk more effectively, frame smarter negotiations, and ultimately capture more value.

Ready to accelerate your valuation workflows and eliminate manual forecast updates? Harness Daloopa’s AI-powered data pipelines to automate TTM and NTM metrics directly in Excel, so you spend less time mining filings and more time uncovering alpha.

Seize the edge in your next deal—empower your models with Daloopa’s complete, auditable data and free up hours for strategic insight.